One week ahead of the all-important ECB meeting, President Mario Draghi delivers opening remarks at the ECB conference in Frankfurt.

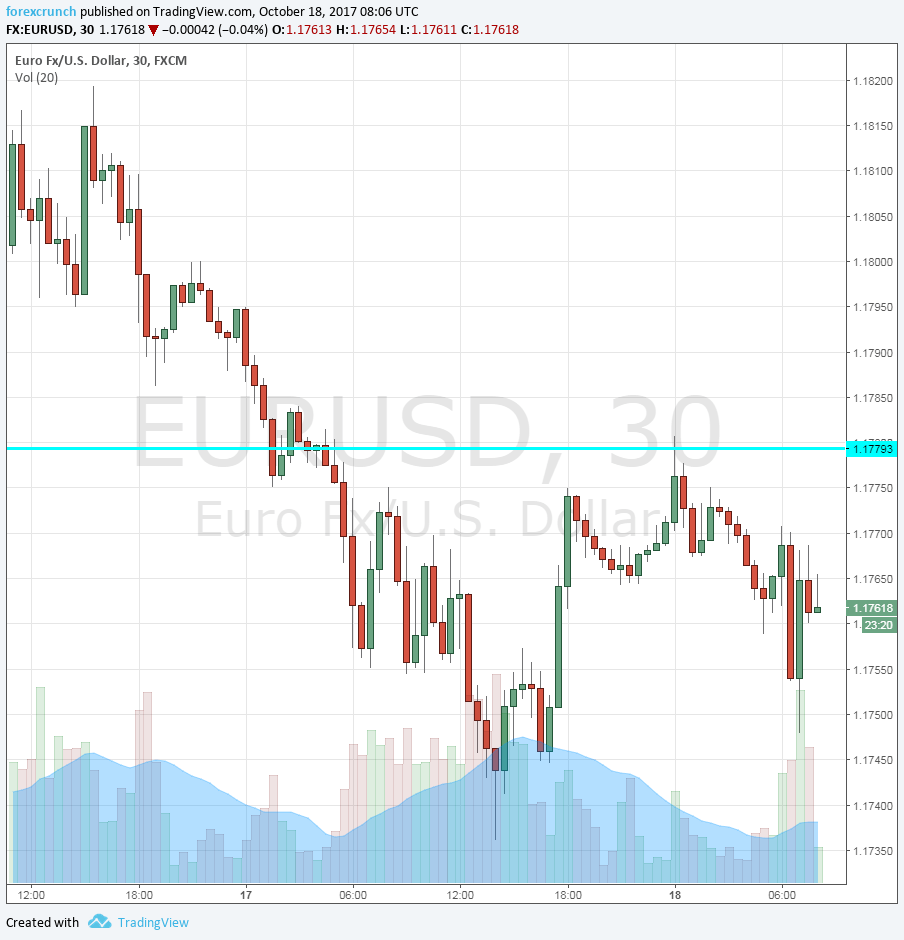

EUR/USD was trading in a narrow range of only 33 pips ahead of the speech, and it seems he is unable to move the needle in the world’s most popular currency pair.

Draghi’s opening remarks at the ECB conference focus on structural reforms rather than on monetary policy. He ties between the two topics, but it is hard to see anything to move the markets. The “window for economic reforms” that Draghi talks about says nothing about the upcoming QE decision which is of interest to markets.

Here is a quote from the prepared speech:

Perhaps more controversial in recent years has been the question of the interaction between monetary policy and structural reforms. It is often said that monetary policy discourages reforms by taking the pressure off governments to act during crisis times.

Euro/dollar trades around 1.1760. Resistance awaits at 1.1780 and support at 1.1720.

More: EUR/USD in a “buy the dips” mode?

The common currency has been hit by the crisis in Catalonia. The regional government is not planning to address the second ultimatum by the Spanish government regarding the declaration of independence. This is set to lead to a suspension of the autonomy, using Article 155 of the Spanish Constitution.

Here is the 30-minute chart: