The cautious approach weighs on the euro. They are open to adding more QE. The president of the ECB stresses that the rise in inflation is related to energy. The risks to the economic outlook are to the downside. All in all, he is quite dovish. The Frankfurt-based institution is open to adding QE if necessary.

The Bank has not discussed reducing the current levels of stimulus. Unanimous agreement that the December decisions were the right thing to do. Removing the yield limit has significantly increased the universe of bonds up for buying. They did not discuss tapering and he also called for patience regarding inflation and the ECB.

This is one of the key phrases that Mario Draghi uses to dismiss inflation:

There are no convincing signs of an upward trend in inflation

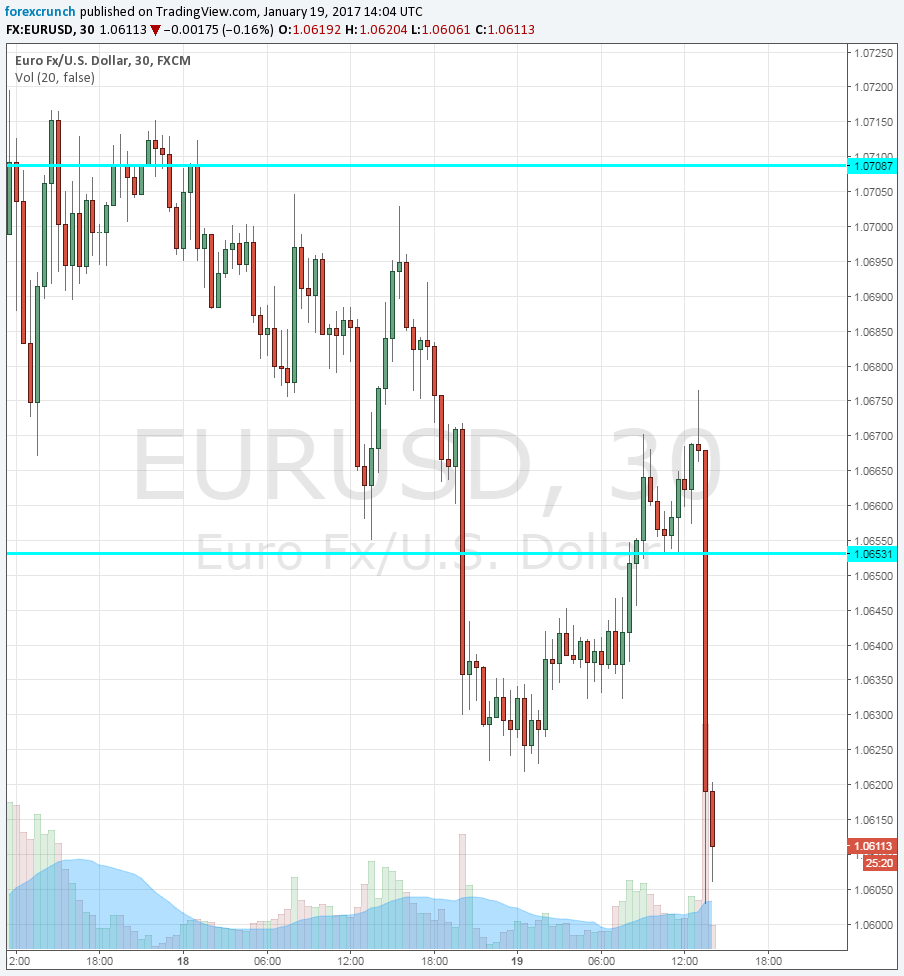

EUR/USD is down around 40 pips from the pre-press conference levels. Update: The new low is 1.0603, some 65 pips under the levels seen before the announcement. A recent low has been 1.0580 and further support awaits at 1.0520.

Draghi also says that there is a sluggish implementation of structural reforms, and this is also unhelpful. He dodges a question about the Donald and the Dollar, just says that countries should refrain from competitive devaluation.

Responding to criticism about hurting German savers, Draghi says that Germany has benefited from the ECB’s policies like everybody else.

Headline inflation could rise in the near future but we are yet to see second round effects. The risk of deflation has largely disappeared.

4.5 million jobs were created in recent years, and the ECB led expanding policies. Draghi says they are not exclusively responsible for this, but asked the reporter who else provided such policies. The ECB proved it can act independently.

Here is the EUR/USD chart:

Earlier, they announced that no policy measures are changed.

Live coverage: