The prepared statement of ECB President Mario Draghi has been released as he speaks, and its not earth shattering so far. Draghi sees inflation recovering in a lower than expected pace, but we already know that from the ECB press conference earlier in the month.

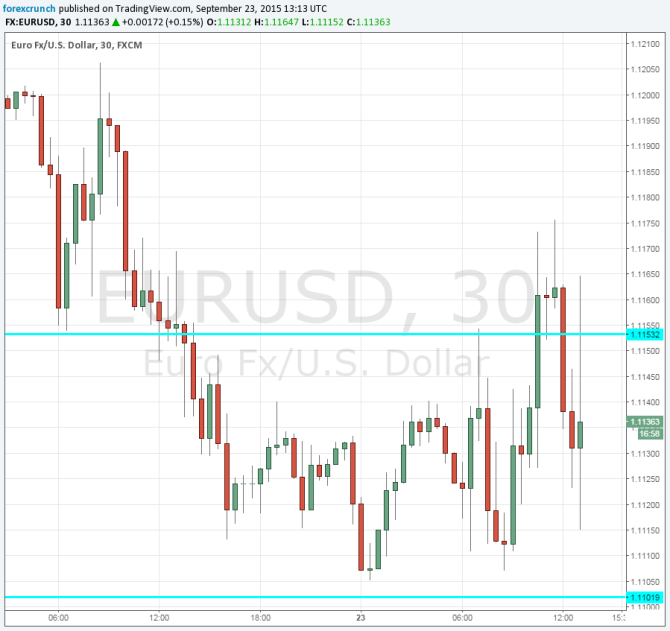

EUR/USD is ticking up within the range, back up 1.1160, up from falling on more dovish ECB comments earlier. It could certainly get more interesting once he tackles questions.

On QE, Draghi says they can change it, and that’s not news.

On inflation, he sees it falling to near zero in the very near term but rising towards the end of the year.

Draghi, like Yellen, sees risks in emerging markets and also mentions oil prices (no surprise) and the exchange rate. The latter isn’t reacting so far, as Draghi has already elegantly entered the currency wars.

He cites renewed downside risks (as heard in that recent presser) but also notes that it is too early to tell if the latest weakness will last.

All in all, EUR/USD maintains the recent ranges. We had some relatively hawkish talk early in the day from central European ECB members, but this was countered by Peter Praet, who leans to the dovish side.

Markets were already pricing in action from the ECB, so no news is good news, or at least we have no further deterioration at the moment. The key line is 1.11

In our latest podcast we explain why the dollar defies the doves