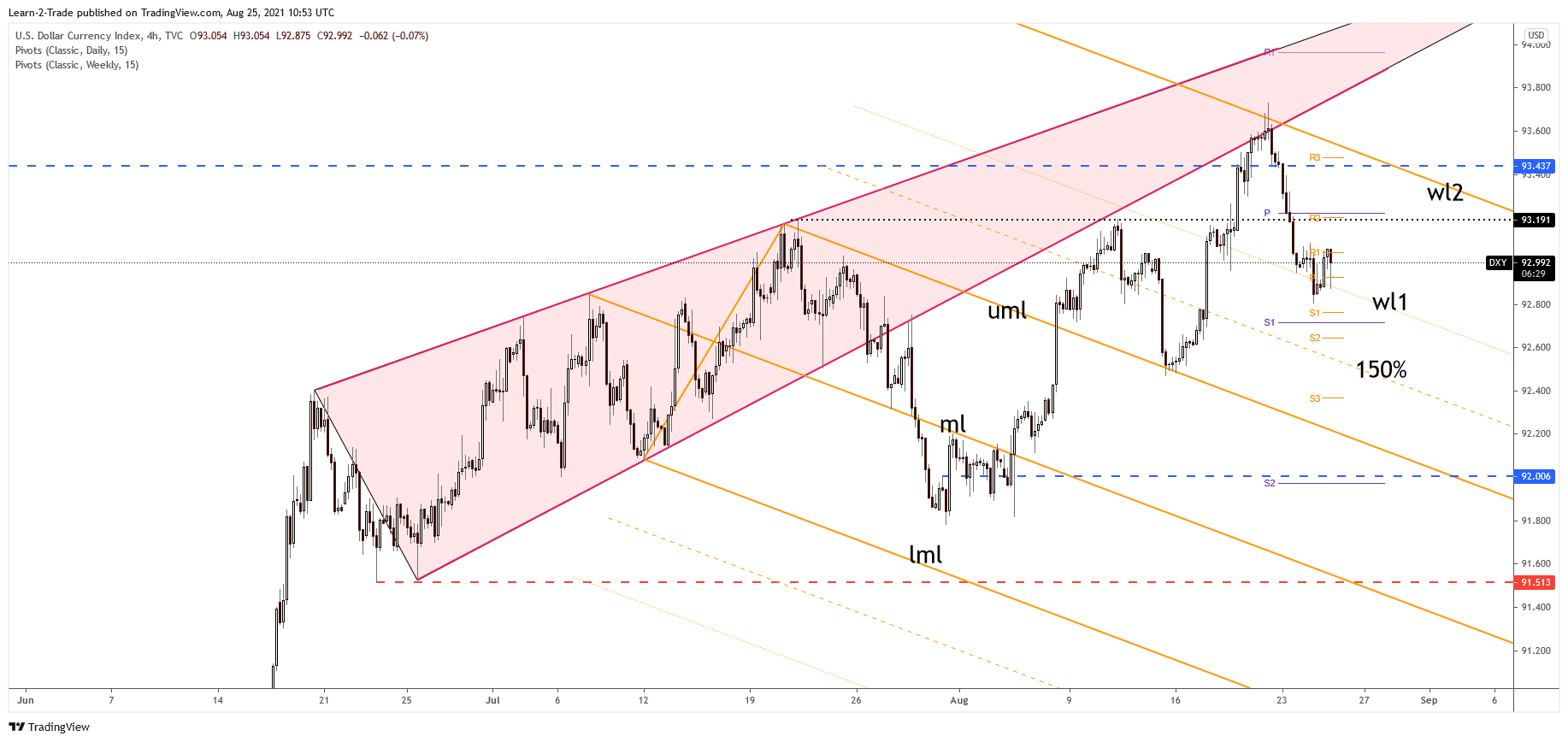

- DXY has found support, and now it tries to come back towards the immediate resistance levels.

- The bias is still bullish, so a valid breakout through the second warning line (wl2) could signal an upside continuation.

- Technically, a new lower low could invalidate the upside scenario and could signal a strong drop.

The DXY Dollar Index price has been into a corrective phase in the short term. Technically, the index has reached dynamic support and now it tries to gain back higher.

However, it remains to see how it will react around the US data. Fundamentally, the DXY needs strong support from the US economy to be able to start raising again.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

The Durable Goods Orders is expected to drop by 0.3% in July versus 0.9% growth in June, while the Core Durable Goods Orders could increase by 0.5% in July, the same as 0.5% growth in June. The DXY Dollar Index has found support and now is fighting hard to recover after the US New Home Sales was reported at 708K versus 698K expected in yesterday’s session.

Tomorrow could be decisive as well. The US Prelim GDP, Unemployment Claims, and the Jackson Hole Symposium could bring sharp movements. Also, on Friday, the Core PCE Price Index and the Fed Chair Powell Speaks could shake the markets as well.

Dollar Index price technical analysis: Oversold signs to provide respite

The DXY Dollar Index has found strong resistance at the second warning line (wl2) of the former descending pitchfork and the former uptrend line, so a temporary decline was natural. It has dropped below the warning line (wl1), but it has failed to stay there, signaling that the downside movement is over.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

Failing to approach and reach the weekly S1 (92.71) signaled that DXY could come back higher towards the 93.19 static resistance. Thus, the outlook is still bullish despite the current drop. However, you already know from my previous analyses that an upside continuation could be invalidated by a new lower low.

The price should drop below the 92.47 level to confirm a major downside movement and invalidate the bullish scenario. Technically, jumping and stabilizing above the 93.43 static resistance could signal more gains. Making a valid breakout through the second warning line (wl2) may also announce a breakout through 93.43.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.