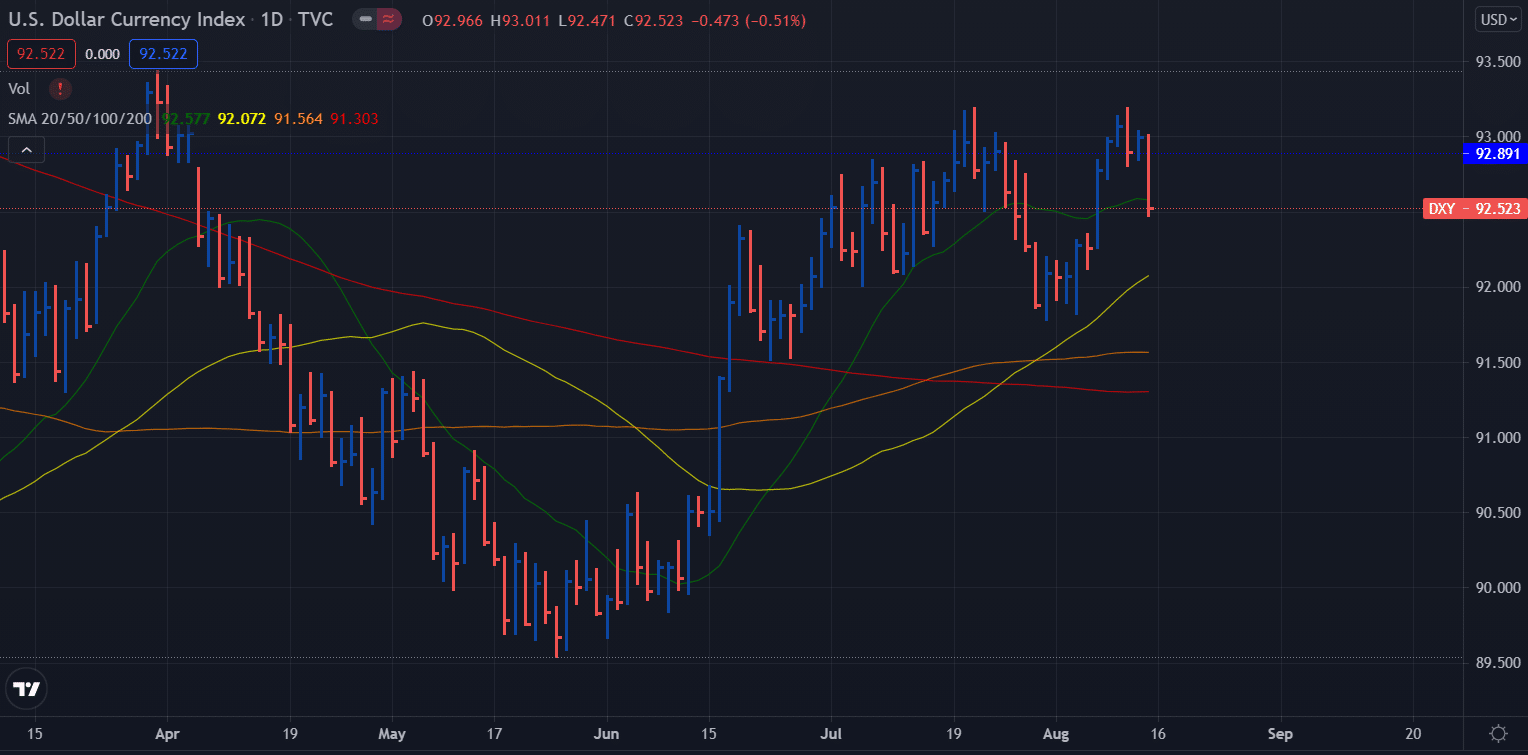

- DXY saw a sharp sell-off on Friday as the bonds yields fell.

- Gold rises as the delta variant continues to dent the market sentiment.

- Retail sales and FOMC meeting minutes are the key events to watch next week.

The DXY Dollar Index weekly forecast is bearish as the bonds’ yields dropped this week, and the trend may continue next week as well. On Friday, the US dollar fell sharply as the yield on 10-year government bonds fell.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Increasing US yields have long been identified as a key factor contributing to US dollar volatility, and that impact is evident as the week ends.

Financial investments are finally catching up with concerns about the delta option. In the early part of the week, gold prices fell but stayed low due to concerns about the Coronavirus. In addition, the list of banned cities is growing as countries around the world impose social distancing and mask restrictions.

It’s not surprising that consumers, investors, and businesses are getting nervous as this trend spreads. If other countries enact tighter restrictions this fall, travel and recreation could be adversely affected.

The University of Michigan Consumer Sentiment Index dropped to its lowest level since 2011. The drop in investor confidence in Germany coincided with this. The largest decrease recorded is unexpected, even though we expected a decline.

The US dollar fell, yields fell, and gold rose. Stocks are rising, but it shouldn’t take long for them to improve as well. Risk aversion will be widespread if this happens. Moreover, equities may be on their way out as the pandemic deepens, making maintaining record highs more difficult.

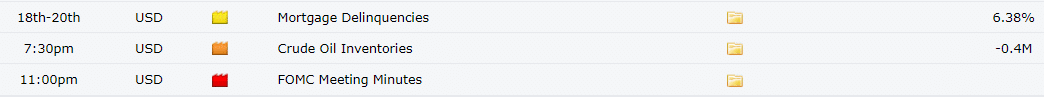

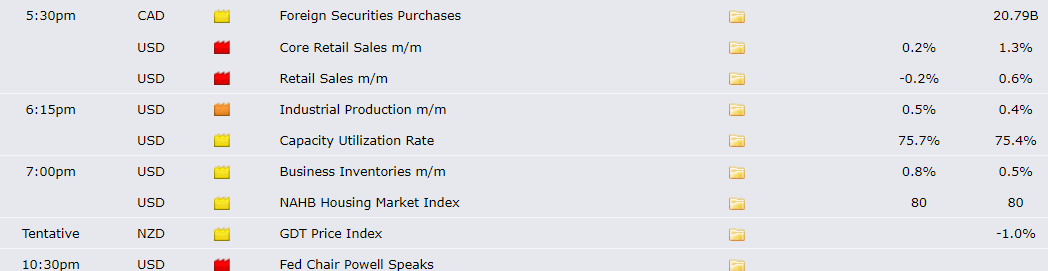

America’s key events during Aug 16 – 20

The risks appetite and stocks will be closely monitored next week. In addition, the calendar is rife with event risk. US retail sales are expected to be the most important release for the dollar, along with the minutes of the recent FOMC meeting. Fed Chair Powell’s speech is due on Tuesday as well. However, not much is expected from the event. It is expected that costs will decline, and a decline could lead to a sharp sell-off.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

DXY Dollar Index weekly technical forecast: Bearish dominance is evident

The Dollar Index fell sharply on Friday and pared all gains of the week. The index closed near the weekly lows below the key 20-day SMA. It indicates a continuation of the bearish trend next week. The 100-day SMA near 92.00 continues to provide support ahead of the 91.75 horizontal level. On the upside, the 93.2 (multi-month high and double top) acts as a strong resistance. However, an upside retracement cannot be ruled out.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.