- DXY Dollar index plunges below 20-SMA after the US CPI.

- Fundamentally, further losses are on the cards as Fed’s stance on tapering and rate hikes is mixed.

- The technical view is still neutral to bullish despite a big fall.

The DXY Dollar Index outlook found aggressive selling on Wednesday after the US CPI figures were released. Overall, the US Dollar got weakened against most peers due to increased bets on the riskier assets.

US consumer inflation data released at the last session was met with a subdued reaction, but it is still valuable for future analysis.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

Over the past year, the inevitable slowdown in incredible growth has been one “disappointing” piece of data for traders looking to capitalize on the dollar’s projected return. Price increases slowed from 0.9 percent in June to 0.5 percent last month.

Annually, the headline value remained at 5.4 percent (the highest value since 2008), and, as expected, the core CPI reading fell to 4.3 percent (shortly after the high in 1991).

In addition, these numbers will decrease as the base period (month of the previous year) reflects the increase in demand during and after the pandemic’s peak. Thus, a rate hike may no longer be necessary, but monetary policy must remain normalized even if an extreme pandemic is no longer possible.

A rise in CPI figures positively impacts the markets, but the benchmark for short-term monetary policy speculations is falling.

As part of a stimulus package, all major central banks consider reducing monthly bond purchases above zero percent. Still, the Fed is the largest central bank globally, representing the largest economy and the most widely used currency.

The impact of Feds’ dictations extends far beyond his own market. At the previous session, we received another series of comments from various political authorities based on the established extremes of the Fed scale in Bostics and Evans.

Kaplan said he supported the September announcement and October rollout, George said it was “time for a reset,” and Richmond Barkin said it was time to put yourself at the center of the action. The throttling may not begin for several months, according to Pack. From this point forward, the scale seems to start in September and run through December.

Interest rate forecasts tend to influence market movements, especially FX, but adjusting the rhetoric is unlikely to result in a major dollar rally or the collapse of the S&P 500. Still, it might inspire a more measured move, such as a swing within a certain range.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

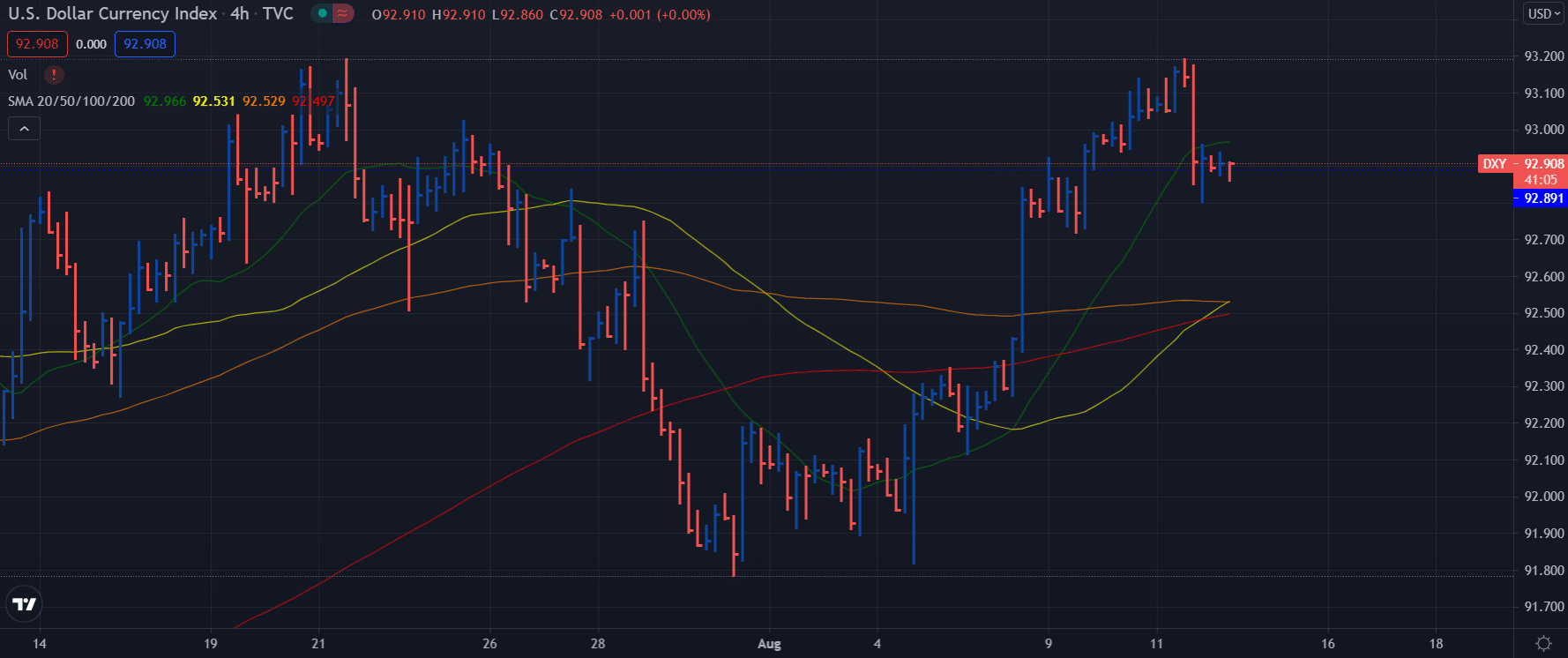

DXY Dollar Index technical outlook: 20-SMA is the key

The index price fell below the 20-period SMA on the 4-hour chart. The index is now consolidating losses. The 50, 100 and 200 SMAs on the sam chart are converging, indicating potential buying in the market. The probability of rising beyond the 20-period SMA and breaking the multi-month top at 93.20 still exists.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.