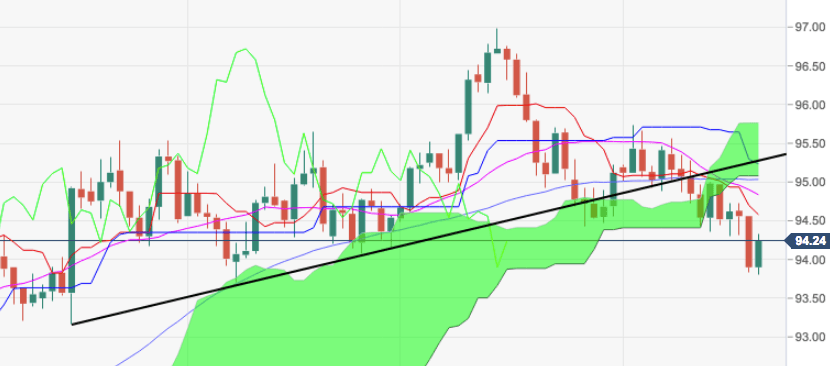

- After a sharp sell-off to the 93.80 region, the index appears to have met dip-buyers along with a change of mood in the risk-associated universe, managing to retake the 94.00 handle and above for the time being.

- The decline in the buck halted just ahead of July’s low at 93.71. This area, along with June’s low at 93.19 should hold the bearish impetus initially.

- For the recovery to become a resumption of the up move, it should ideally surpass the 95.00 area, where coincide the 55-day SMA and September 14 high and the short-term (now) resistance line, today at 95.28.

DXY daily chart

Daily high: 94.33

Daily low: 93.81

Support Levels

S1: 93.63

S2: 93.37

S3: 92.90

Resistance Levels

R1: 94.36

R2: 94.83

R3: 95.09