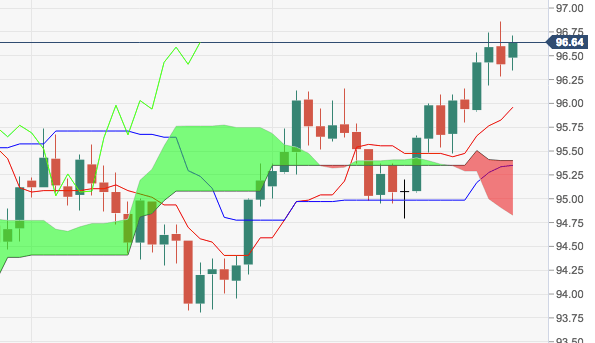

- The index reverted the initial negative mood and is now challenging tops in the vicinity of 96.70, offsetting Friday’s pullback.

- A break above YTD peaks just below the 97.00 milestone should put 97.87 on the horizon, where we can see a Fibo retracement of the 2017-2018 drop and June 2017 peak.

- Sustaining the buck’s rally, the index is extending the move above the daily cloud.

- Further out, DXY stays bid as long as July’s low at 93.71 underpins.

DXY daily chart

Dollar Index Spot

Overview:

Last Price: 96.62

Daily change: 21 pips

Daily change: 0.218%

Daily Open: 96.41

Trends:

Daily SMA20: 95.72

Daily SMA50: 95.21

Daily SMA100: 95.06

Daily SMA200: 93

Levels:

Daily High: 96.86

Daily Low: 96.28

Weekly High: 96.86

Weekly Low: 95.47

Monthly High: 95.74

Monthly Low: 93.81

Daily Fibonacci 38.2%: 96.5

Daily Fibonacci 61.8%: 96.64

Daily Pivot Point S1: 96.17

Daily Pivot Point S2: 95.94

Daily Pivot Point S3: 95.59

Daily Pivot Point R1: 96.75

Daily Pivot Point R2: 97.1

Daily Pivot Point R3: 97.33