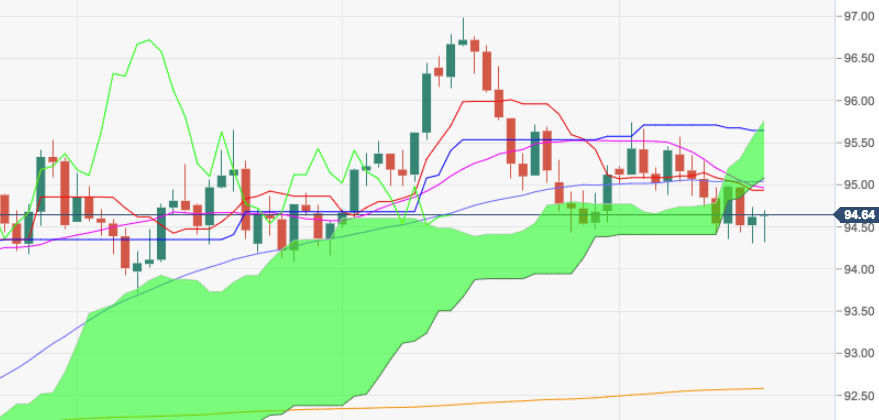

- DXY is struggling to generate some serious traction, while the buck appears so far supported around the 94.35/30 band.

- It looks like the index is attempting to consolidate in the lower end of the range, coincident with August’s lows.

- Immediate hurdle in case the greenback resumes the upside remains the 94.88/95/05 band, home of the 10-, 21- and 55-day SMA ahead of the more relevant short-term now) resistance line, today at 95.25.

- A deeper retracement could lead to a test of 94.20 (38.2% Fibo retracement of the 2017-2018 drop) ahead of 94.08 (late July low).

DXY daily chart

Daily high: 94.69

Daily low: 94.32

Support Levels

S1: 94.37

S2: 94.12

S3: 93.94

Resistance Levels

R1: 94.80

R2: 94.98

R3: 95.23