- The recent upside momentum around the index lost some vigour in the mid-96.00s, allowing for the current knee jerk to the 96.30/20 area.

- Occasional dips, however, have met contention in the 96.15/20 band, or hourly lows.

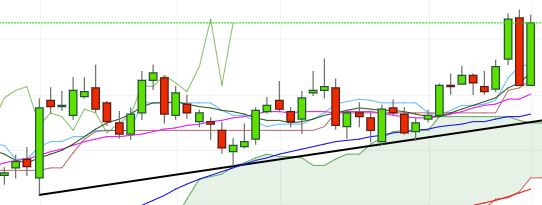

- On the daily chart, the bearish divergence between prices and the RSI (14) allows for a deeper correction in the near term, which should meet interim support at 95.39 (10-day SMA) and 95.02 (21-day SMA).

- The constructive stance, in the meantime, is poised to remain unchanged while the short-term support line, today around 94.55, holds.

DXY daily chart

Daily high: 96.44

Daily low: 96.15

Support Levels

S1: 96.13

S2: 95.96

S3: 95.7

Resistance Levels

R1: 96.49

R2: 96.68

R3: 96.85