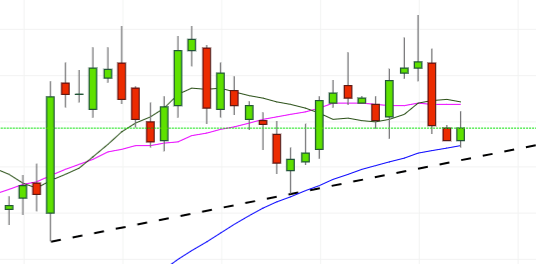

- DXY keeps the leg lower after being rejected from tops beyond 95.60 recorded last week.

- The constructive outlook for the greenback still remains supported by the immediate support line off June lows, today at 94.10.

- Tuesday’s bullish ‘outside day’ pushed the index to YTD tops in the 95.60/65 band, although it lost momentum at the end of the week in response to Trump’s comments on the Fed and USD.

- The hourly ADX retreats from tops and is now hovering over 38, noting that the initial test of 94.60 appears to be losing strength.

DXY daily chart

Daily high: 94.60

Daily low: 94.20

Support Levels

S1: 94.12

S2: 93.78

S3: 93.20

Resistance Levels

R1: 95.04

R2: 95.62

R3: 95.96