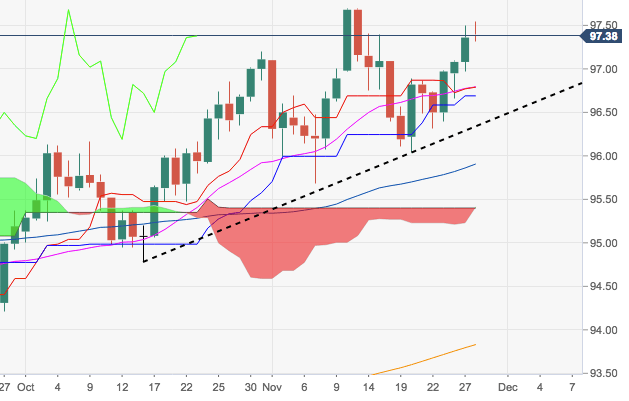

- DXY is looking to extend the up move for another session on Wednesday, so far managing well to keep the trade above the critical 97.00 mark.

- The constructive stance remains well and sound while above the short-term support line, today at 96.33, and July’s low at 93.71 on a broader view.

- A test of YTD highs near 97.70 remains thus on the cards, while further upside should meet resistance at 97.87, where converge a Fibo retracement of the 2017-2018 drop and June’s 2017 peak.

DXY daily chart

Dollar Index Spot

Overview:

Today Last Price: 97.35

Today Daily change: -1.0 pips

Today Daily change %: -0.0103%

Today Daily Open: 97.36

Trends:

Previous Daily SMA20: 96.76

Previous Daily SMA50: 95.98

Previous Daily SMA100: 95.55

Previous Daily SMA200: 93.79

Levels:

Previous Daily High: 97.5

Previous Daily Low: 96.97

Previous Weekly High: 96.98

Previous Weekly Low: 96.04

Previous Monthly High: 97.2

Previous Monthly Low: 94.79

Previous Daily Fibonacci 38.2%: 97.3

Previous Daily Fibonacci 61.8%: 97.17

Previous Daily Pivot Point S1: 97.05

Previous Daily Pivot Point S2: 96.75

Previous Daily Pivot Point S3: 96.52

Previous Daily Pivot Point R1: 97.58

Previous Daily Pivot Point R2: 97.81

Previous Daily Pivot Point R3: 98.11