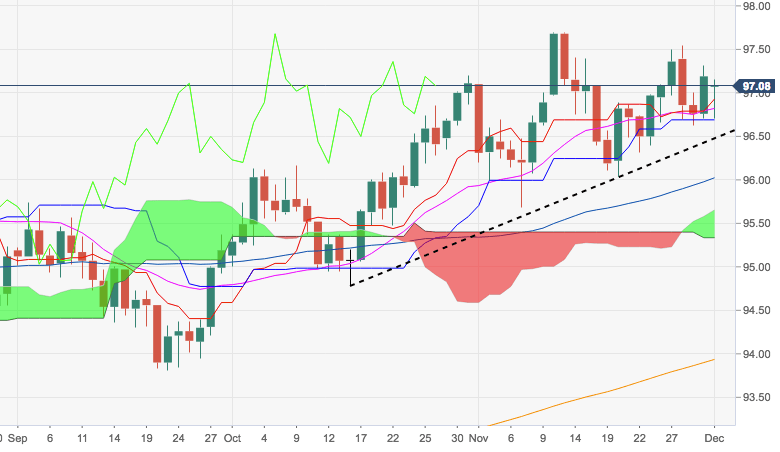

- The index has managed to regains the 97.00 handle and above on Monday after bottoming out in the 96.70 region earlier in the day.

- The constructive bias in the buck remains underpinned by the short-term support line, today at 96.47, and therefore keeps targeting YTD peaks near 97.70 (November 12).

- Below this key area aligns the 55-day SMA at 96.00, coincident with mid-November lows and a Fibo retracement of the 2017-2018 drop.

DXY daily chart

Dollar Index Spot

Overview:

Today Last Price: 97.07

Today Daily change: -12 pips

Today Daily change %: -0.123%

Today Daily Open: 97.19

Trends:

Previous Daily SMA20: 96.81

Previous Daily SMA50: 96.14

Previous Daily SMA100: 95.61

Previous Daily SMA200: 93.9

Levels:

Previous Daily High: 97.31

Previous Daily Low: 96.71

Previous Weekly High: 97.54

Previous Weekly Low: 96.62

Previous Monthly High: 97.7

Previous Monthly Low: 95.68

Previous Daily Fibonacci 38.2%: 97.08

Previous Daily Fibonacci 61.8%: 96.94

Previous Daily Pivot Point S1: 96.83

Previous Daily Pivot Point S2: 96.47

Previous Daily Pivot Point S3: 96.23

Previous Daily Pivot Point R1: 97.43

Previous Daily Pivot Point R2: 97.67

Previous Daily Pivot Point R3: 98.03