- The US dollar ended the week higher despite some conflicting US economic data during the week.

- The week’s events will conclude on Wednesday with a meeting of the US Federal Reserve.

- Mr Powell may repeat his year-end promise without clarifying its content, but his move would largely depend on US data.

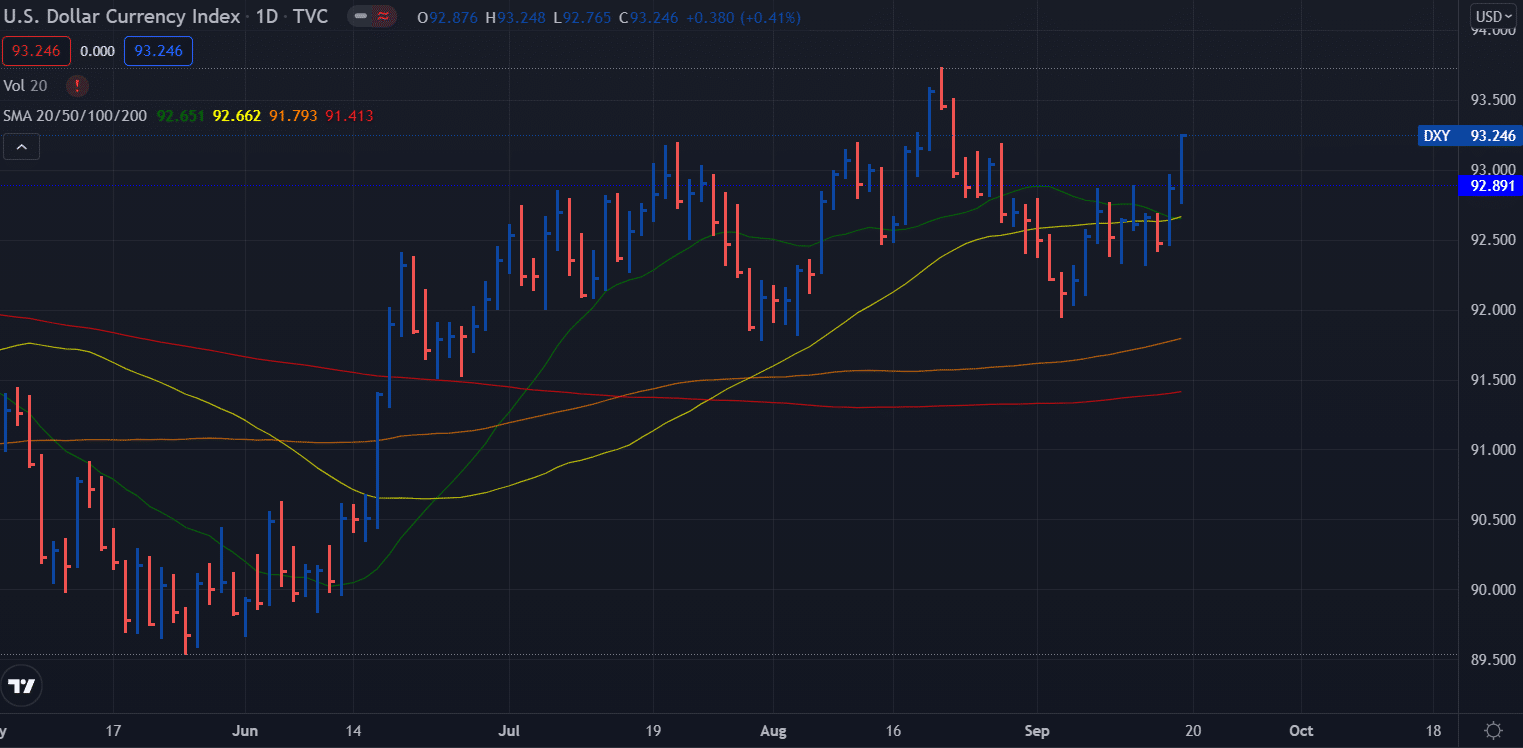

The weekly forecast for the DXY dollar index is bullish as the net positive change for the week is 60 pips. Moving into the next week, the FOMC press conference is the key market mover.

-Are you looking for the best CFD broker? Check our detailed guide-

The US dollar ended the week higher despite some conflicting US economic data during the week. The pair started the week at 92.64, marked the weekly highs at 93.24 on Friday. After that, however, the price saw a dip to the weekly lows of 92.30 on Wednesday before finding a mid-week bullish reversal and turned higher.

As the US consumer price rise slowed in August, the Federal Reserve found a reason to postpone reducing bond purchases. As a result, after the consumer price index was released on Tuesday, the USD/JPY fell to a weekly low on Wednesday.

On Thursday, it was forecast that retail sales for August would decline for the second consecutive month. Within a month, Michigan’s consumer sentiment dropped to its lowest level in ten years. However, despite limited automobile sales, consumers had the busiest month since January. In addition, the Dollar Index marked two consecutive days with winning streaks on Friday.

A slight increase was also noted in government bond yields. Through Friday, the yield on the 10-year note rose 3 basis points to 1.370% after opening the week at 1.340%, falling 1.279% on Tuesday’s CPI data.

What’s next?

The week’s events will conclude on Wednesday with a meeting of the US Federal Reserve. However, the markets will remain calm until then.

US Treasury yields will rise if the Fed announces its tapering plan. How much the tapering will depend on how and when it should be made. The DXY should reach 93.75 easily. The yield on 10-year bonds could rise to 1.50%.

Mr Powell may repeat his year-end promise without clarifying its content, but his move would largely depend on US data.

Should Mr Powell not follow through on his promise to taper assets purchases, the sharp drop in bond yields will almost be instantaneous.

The United States housing market is experiencing constant tension. As a result, the sale of existing and new apartments is expected to show strong sales and up-to-date information on price increases.

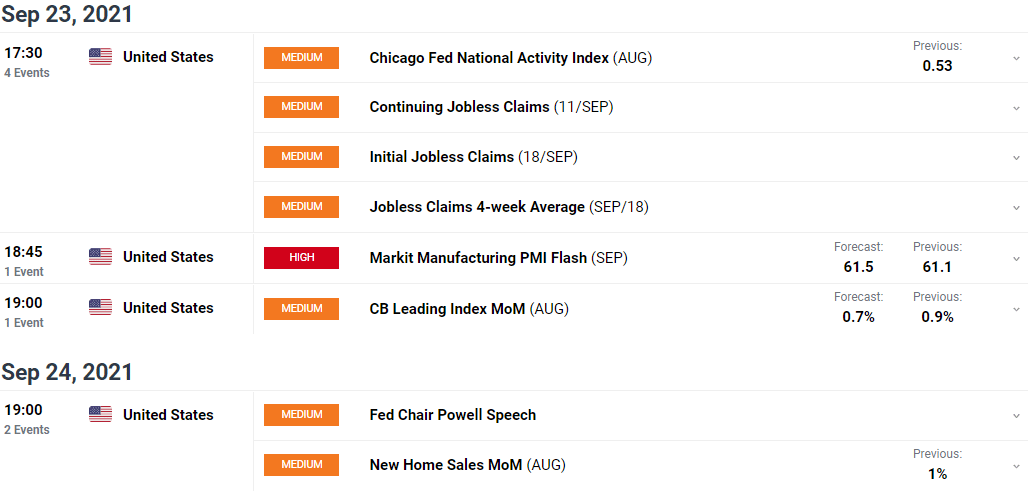

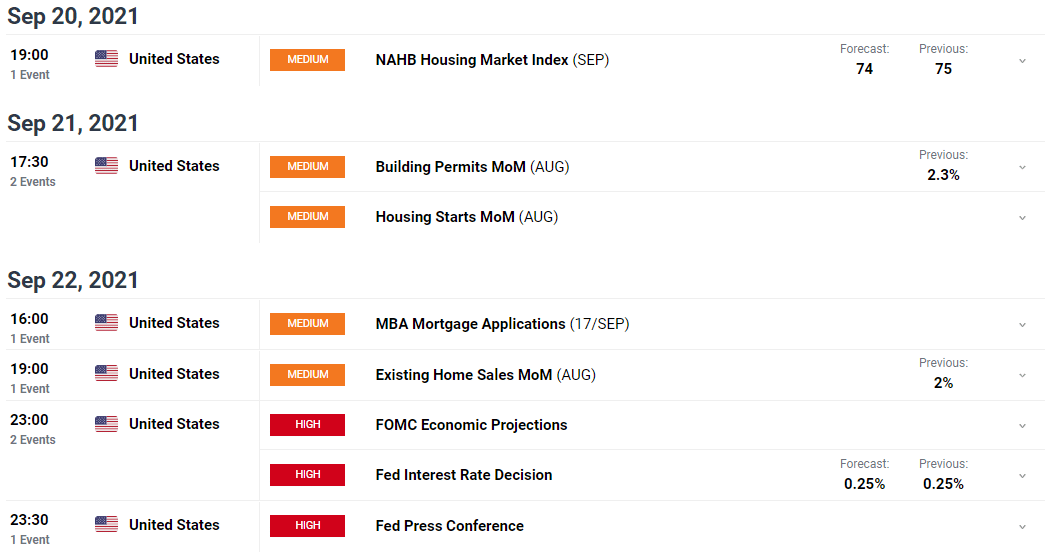

Key data events from the US next week

The week’s major event is the FOMC interest rate decision, followed by the press conference on Wednesday. Investors will likely look for clues of rate hikes and tapering from the press conference. The next important event is Market Flash PMI data on Thursday.

-Are you looking for forex robots? Check our detailed guide-

DXY weekly technical forecast: Poised to hit 93.75

The DXY price managed to break the long-held resistance at 92.47. A mildly bullish crossover between 20-day and 50-day SMAs confirms a bullish continuation towards multi-month highs at 93.75. However, the price has slightly breached the horizontal level of 93.20, and it is still a question whether the index will find acceptance above the level or not. Therefore, we may expect a slight downside correction before moving higher. The immediate support comes into play at 93.00 ahead of 92.80 and then 92.50.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.