- US dollar firm and approaching Feb 4th highs from a significant technical support structure.

- US economy moderately gathering pace according to the Fed’s Beige Book.

The US dollar continues to gain on Wednesday, up by 0.17% at the time of writing as the bulls test the bearish commitments at the 91 figure. The index has travelled from a low of 90.63 to a high of 91.06 so far on the day.

The February 4 highs of 91.60 ahead of the November 23 high near 92.80 are in focus.

The dollar has been supported by a steep rise in US yields and in evidence that the US economy is gathering momentum in Q1.

- Fed’s Beige Book: Most businesses remain optimistic regarding the next 6-12 months

However, the volatility in the US Treasury market seem to be subsiding which had given stocks a boost on Tuesday. However, the yield curve is still very steep and stocks are under pressure again as bond yields tick up.

The yield on the US 10-year note was 8bps higher at 1.47% at the time fo writing, however below the highs of the day at 1.496%, albeit well below last week’s high near 1.61%.

The 3-month to 10-year curve is at 142 bp vs. last week’s high near 1.49 bp, while the 2- to 10-year curve is at 132 bp and is nearing last week’s high near 135 bp.

While there has been some stabilisation of the band market, the drama is by no means over.

Volatility could pick up again in the coming days, especially on a solid jobs report Friday (consensus is 188k), as the long end of the US curve would be presumed to sell off again before the Fed media embargo kicks in for the March 16-17 FOMC meeting.

Meanwhile, the US economy was looking as though it was gathering momentum in the first quarter according to the February ISM manufacturing PMI. This came in at 60.8 vs. 58.9 expected and 58.7 in January and was the highest since May 2004. The employment sub-index rose to 54.4 vs. 52.6 in January and was a positive clue for Friday’s jobs data.

However, in stark contrast, for data on the day, the fall in the ISM services index to 55.3 vs 58.7 took it to its lowest level since last May. In other data, February ADP jobs undershot expectations rising 117k vs a consensus of 200k. The data will bias expectations for Friday’s NFP report downwards.

Meanwhile, President Biden’s stimulus package is looking increasingly likely to win the support of moderate Democrats, with the package expected to be around USD1.6/1.7trn.

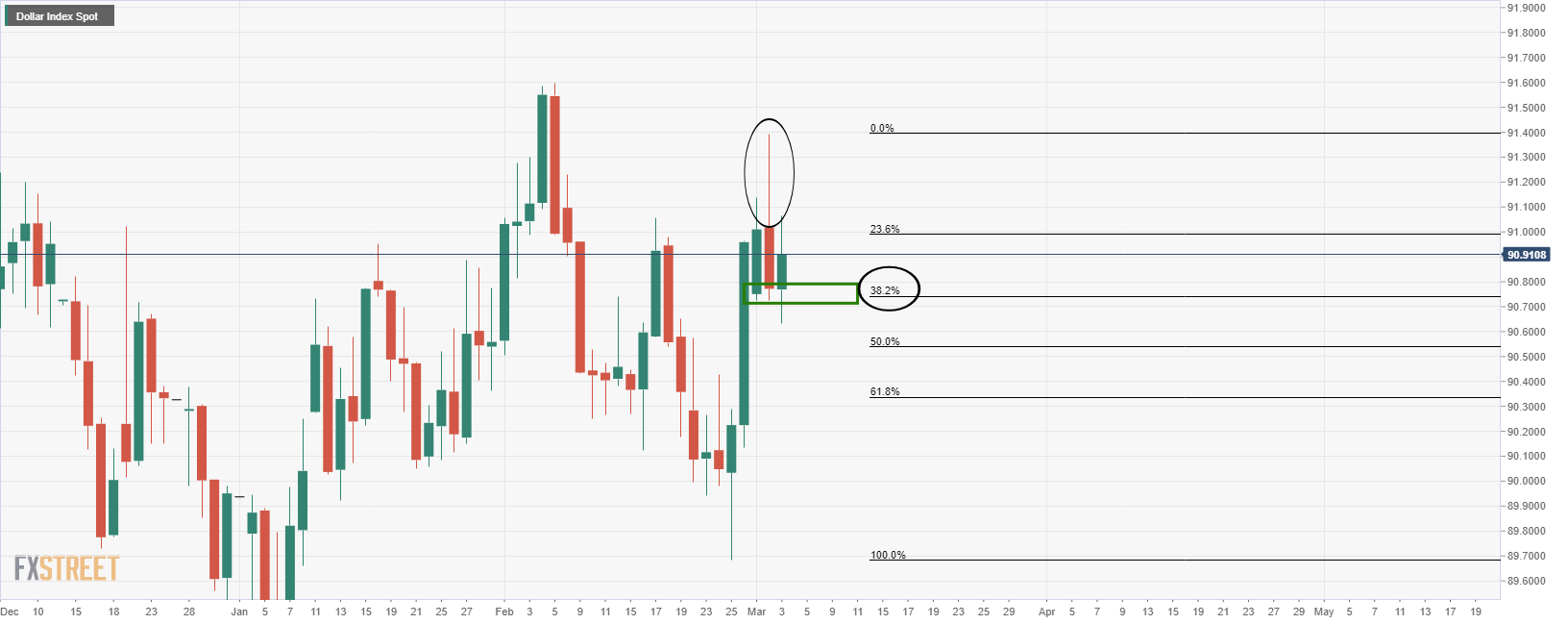

DXY technical analysis

We have a mixed outlook on the daily chart with a strong rejection leaving a bearish wick while at the same time, bouncing from a significant 38.2% Fibonacci retracement support structure.