EUR/USD grinds above 1.10 in the wake of the trading week, amid very thin trading volume. The victory of Emmanuel Macron was mostly priced in. 1.1020 is the high so far, in a relatively muted response.

Real votes are being counted in France but the result is clear: Macron won by a landslide. Exit polls showed 65% and Le Pen has already conceded defeat. The next political battle is the elections to the French parliament, but the biggest factor that held back the euro was the elections.

Opinion polls projected a clear victory for the centrist, and this pushed the common currency higher as we got closer to the vote. However, there may be some more gas in the tank for the euro. After last year’s big political shocks, nothing was taken for granted.

French elections – all the updates in one place.

EUR/USD trading

We still do not have an updated chart as the data is based on very thin trading volume from New Zealand. The charts will be updated later. A second reaction to the result will be seen when volume beefs up at the Tokyo open. The full reaction will probably wait for the European session.

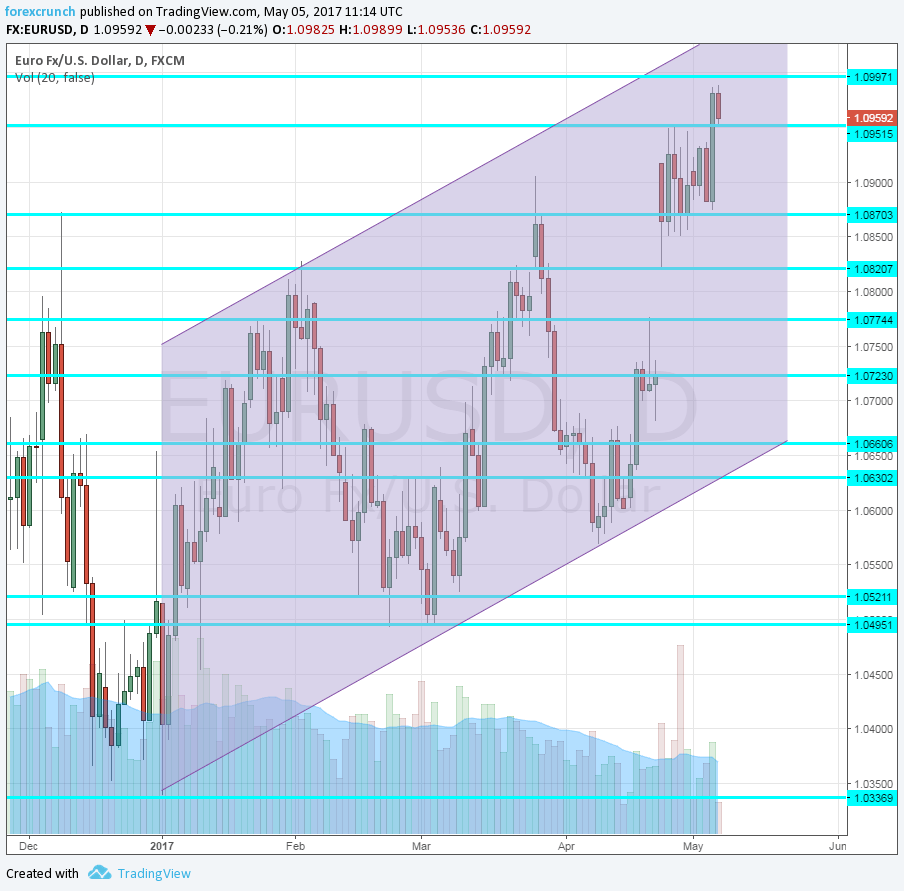

In any case, EUR/USD is trading in an uptrend since the beginning of the year and there is no reason to see a break to the downside at this point.

Above 1.10, the pair could find initial resistance at 1.1050. The next hurdle is 1.1120, which was support in the spring. The last big line on the topside is 1.13.

On the downside, we find 1.0950, which was the first post-first-round high. 1.0870, the high of December, is next. 1.0820 was the post-elections low and this is followed by 1.0720.

And after the French elections are over, there are other factors.

EUR/USD: Four factors that shape the next move

Here is the upwards channel: