After Draghi’s double disappointment, he did take provide something for the bears: this may not be a “one and done”: the European Central Bank could lower the interest rate.

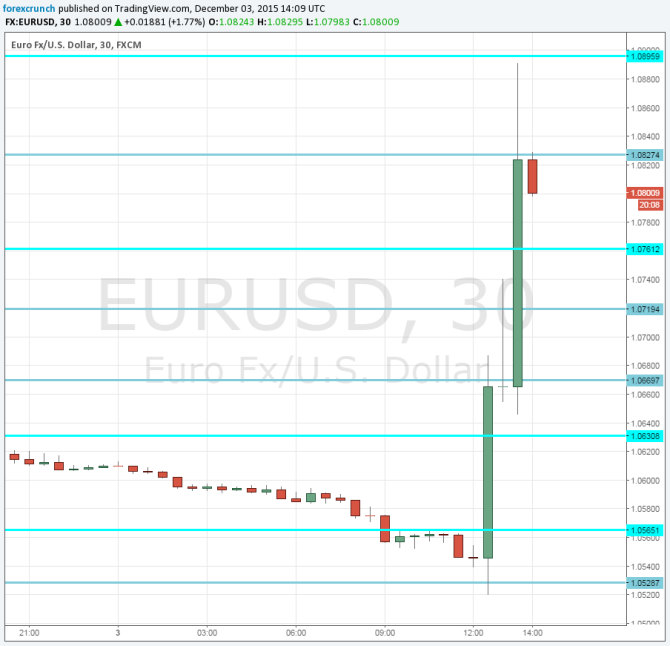

EUR/USD is off the extreme highs of 1.0890 and slips to 1.08.

In the past, Draghi said that rates have reached their lower bound. And in October, he opened the door for new cuts. This time they offered a cut and also an open door. The president of the ECB says that the institution will not be hampered by technical hurdles and they could re-visit this in the spring.

Earlier, he gave the euro bulls everything they had dreamed of: the ECB cut the negative deposit rate by only 10 basis points to -0.30% – at the minimum of expectations. Some, including in this neck of the woods, had expected -0.40% or even -0.50%.

In addition, QE was predicted to rise by 10 to 20 billion, with the average on 15 billion to 60 billion. Draghi provided nothing on this front.

He only offered re-investing proceeds and buying municipal bonds.