QE is probably priced into the price of EUR/USD, but at what size? Could we see a “buy the rumor, sell the fact” reaction? Or perhaps the markets are actually underestimating Draghi and we could have a surprise to the other direction?

The team at UBS explains:

Here is their view, courtesy of eFXnews:

The ECB is widely expected to trigger sovereign QE on Thursday, 22 January, but the exact modalities are still hotly debated amongst market participants.

Size: aiming at EUR 1trillion.

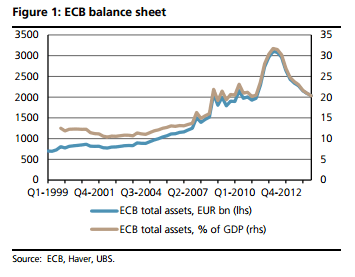

In this regard, UBS’ base case is that the ECB is set to announce purchases of EUR 1trn (sovereign debt, possibly augmented by corporate and supranational debt), but leave the door open for more in the future, should inflation fail to move back towards the target of “close to but below 2%” within an acceptable period of time.

“The ECB might react to its “Greek challenge” by keeping the credit risk of its purchase (at least partly) on national central banks’ balance sheets – a likely controversial concession Mr Draghi might have to make to gain greater support among the hawks on the Governing Council,” UBS adds.

FX markets may be in for a surprise.

“The dominant sentiment in FX markets seems to be scepticism and many seem to expect the ECB to underwhelm. However, we think the market may underestimate Mr. Draghi’s determination. The ECB is well aware of the risks associated with disappointing markets on QE and will try hard to surprise to the upside, in our view,” UBS argues.

“A bolder than expected move by the ECB would be euro negative initially. Depending on how powerful the communication is, the downside for the euro could quite easily be towards 1.10 against the dollar,” UBS projects.

&For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.