The improving economic conditions in the euro-zone are a blessing, but they have a side effect: a stronger currency. The weaker rate helped boost exports and inflation, and the ECB doesn’t like the recent strengthening.

The meeting minutes by the Frankfurt-based institution reveal concerns:

Regarding exchange rates, while it was remarked that the appreciation of the euro to date could be seen in part as reflecting changes in relative fundamentals in the euro area vis-Ã -vis the rest of the world, concerns were expressed about the risk of the exchange rate overshooting in the future

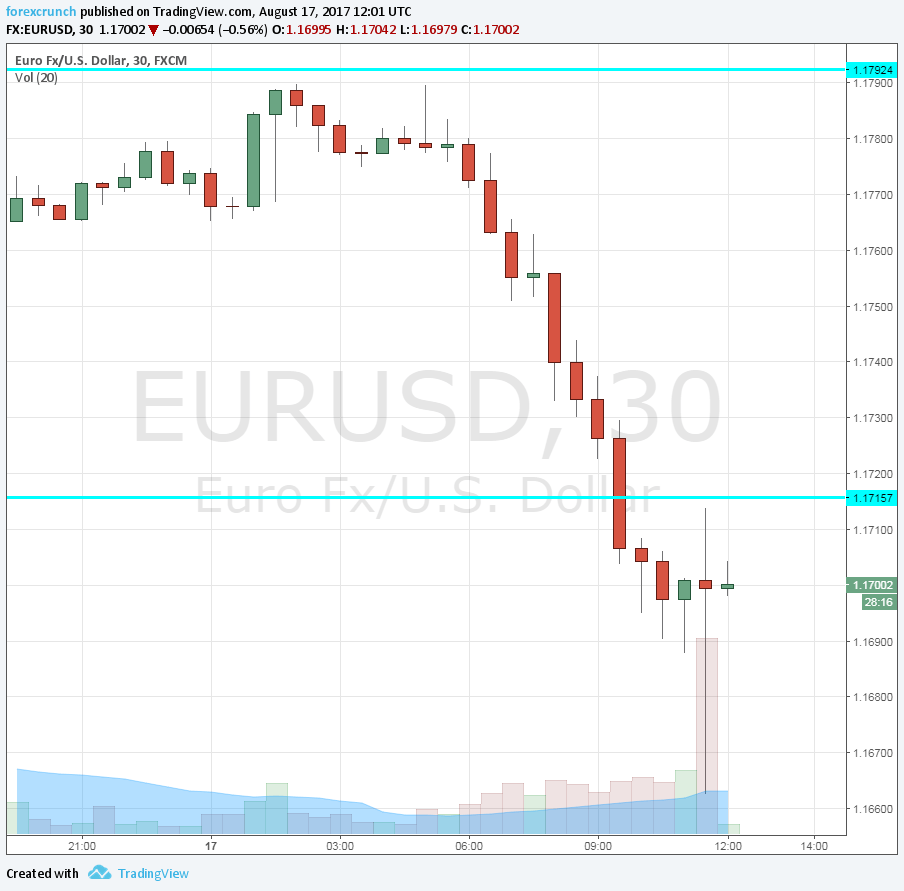

EUR/USD is trading around 1.17 and it must be noted that the pair slipped from the highs well before the document was released. The publication sent it to 1.1662 but bounced back up quite quickly.

The minutes also consist of other noteworthy mentions. Mario Draghi and his colleagues are pleased with the economic upturn and see it as broadly balanced. However, inflation is still a worry, and they put a growing importance on wages.

Earlier, euro/dollar was on the rise thanks to a weakening of the dollar. Economic indicators, the Fed minutes and also the disbanding of Trump’s economic councils all hurt the greenback. However, the US dollar then began advancing across the board.

Here is how it looks on the chart: