Will the size of the ECB’s QE be big big enough to push the euro even lower? It does not have to be that extreme: Draghi could find a way to surprise the markets and weigh on the common currency.

The team at Goldman Sachs explains:

Here is their view, courtesy of eFXnews:

Goldman Sachs expects the ECB to announce on Thursday a sovereign debt purchasing program sized between EUR500bn and EUR1trn with purchases to be mutualized.

“We think full mutualisation will be more effective in impacting EUR/USD. That is because the Euro downtrend has in our minds always been about regime change at the ECB, the switch to a more activist central bank that began with President Draghi’s pre-announcement of the deposit rate cut in May,” GS argues.

“The cleanest continuation of that regime break would be to announce fully mutualised bond buying, not least since this would go furthest towards relaxing fiscal constraints on the periphery, thereby boosting inflation expectations,” GS adds.

But even if sovereign bond purchases end up not being fully mutualised, GS thinks President Draghi will find a way to surprise the market on the dovish side (potentially on the size of the program or speed of purchases). GS outlines 2 reasons behind this:

“First, sovereign QE would put the ECB on the sidelines for some time, much like the BoJ, which after the start of QQE in April 2013 was only able to step back into the ring in October 2014. The cost of underwhelming the market is therefore large, since the ECB would have to live with the outcome for some time,” GS clarifies.

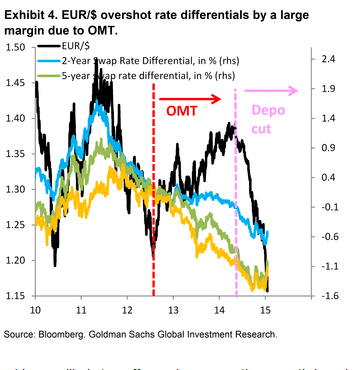

“Second, to a significant degree low inflation in the Euro area reflects past Euro strength, because the OMT caused a sharp appreciation of EUR/$ between mid-2012 and early 2014, far above what rate differentials were justifying. This appreciation was essentially a large, deflationary shock for a region where growth was already struggling and now needs to be reversed by driving EUR/$ significantly below fair value, as our forecasts imply. Even though the Euro is clearly not a policy target for the ECB, we think a lower Euro is therefore a necessary condition for ECB QE to be a success,” GS adds.

“In short, we continue to see this week’s ECB meeting as a catalyst for EUR/$ lower,” GS concludes.

&For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.