The European Central Bank refrained from more monetary stimulus in the last 2014 meeting and the euro jumped.

However, euro-zone QE is far from being shelved. The team at BNP Paribas stay short, explain why and provide targets:

Here is their view, courtesy of eFXnews:

The ECB decision this week disappointed elevated expectations but the ECB’s language continues to get more dovish and President Draghi promised the ECB will reassess early next year and could introduce more aggressive asset purchase measures at that time, notes BNP Paribas.

“However, despite acknowledging that the outlook has worsened since the last forecasts, he declined to introduce new measures or send a strong signal,” BNPP adds.

EUR price-action near-term.

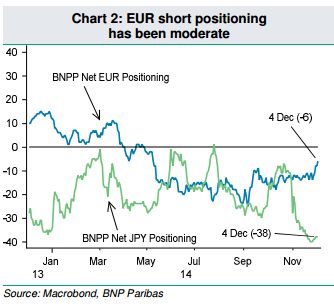

“However, price action in the 48 hours ahead of the meeting suggests a scramble to add exposure to EUR downside heading into the event. These weaker positions are at some risk now and it would not be a surprising to see a squeeze up through 1.25 near term,” bnpp argues.

EUR Risk-Reward ino 2015.

“Despite the near term upside risks, however, we think risk reward remains attractive for running EUR shorts heading into the new year,” BNPP advsies.

“President Draghi’s comments continue to show that the central bank is very focused and aware of the risks from falling inflation expectations. He does not have a consensus to take new measures at this time, but the central bank is prepared to act in Q1 if the current measures do not succeed in reversing the decline…Our economics team continues to expect the ECB to adopt broader asset purchases in Q1 in response to stubbornly low inflation,” BNPP clarifies.

In line with this view, BNPP remains short EURUSD and EURGBP and expect EURUSD to reach 1.20 by the end of Q1

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.