- The ECB is set to leave rates unchanged but comments on the exchange rate are set to rock the euro.

- New forecasts are likely to show a minor upgrade to economic forecasts.

- ECB President’s Lagarde words on using the full extent of the stimulus package is also of importance.

Glass half-full or half-empty? The European Central Bank’s approach on three topics – opting for optimism or pessimism – is set to make the difference for EUR/USD. The Frankfurt-based institution is set to leave its policies unchanged with the deposit rate staying at -0.50% and the total Pandemic Emergency Purchase Program volume at €1.35 trillion.

Here are three things to watch out for:

1) Euro exchange rate

The most significant mover of the euro would be – talk about the currency. Philip Lane, Chief Economist at the ECB, said he is “watching” the exchange rate. A Financial Times article quoted “sources” at the bank that also expressed concern about the value of the euro.

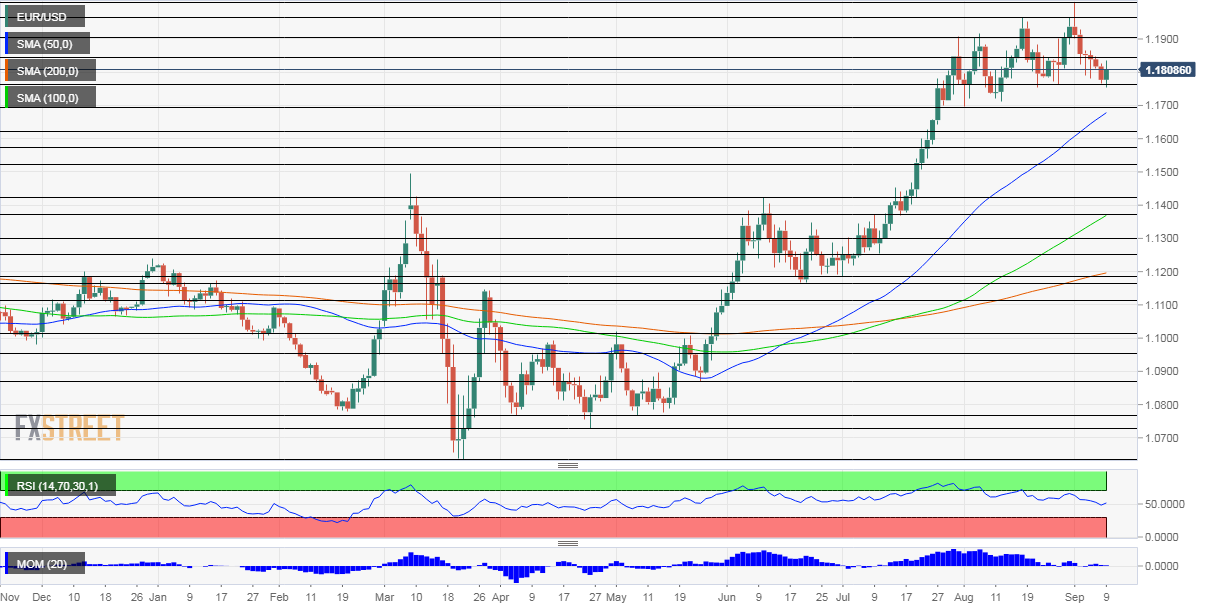

EUR/USD has been on an uptrend since the spring:

That was when EUR/USD traded at around 1.20 and it has since edged down. Is the exchange rate still of worry to the bank? The ECB is unlikely to mention the rate in the statement, nor in the opening statement. However, ECB President Christine Lagarde will surely be asked about it.

If she says that the bank “does not comment on the exchange rate – or dodges the question altogether – the euro may have room to rise. Conversely, if she, as the head of the institution, conveys a message of unease, the common currency may shed some ground.

Intervention is certainly not on the cards. Nevertheless, saying that the ECB is watching the value of the currency implies it may push it down with more accommodative policy later down the road – and investors could preempt that by selling the euro.

At the current juncture, investors expect Lagarde to express some concern about the exchange rate. Therefore, there is an upside risk for the euro if she dismisses the topic.

2) More optimistic forecasts?

The ECB publishes new growth and inflation forecasts every three months. According to Bloomberg, the bank is set to upgrade these projections – or at least express more confidence in the recovery. The institution previously stressed that any estimates are highly uncertain due to the unprecedented nature of the pandemic.

The news about elevated confidence has already sent the euro higher, leaving room for a downfall if the ECB leaves them unchanged or even lowers them.

The bank could also express concern about the recent increase in COVID-19 cases across the old continent. Spain and France – Lagarde’s home country – are struggling more than most. The mix of already rising coronavirus infections and the specter of worsening in the autumn could trigger a more cautious message.

Overall, an upgrade in Gross Domestic Product forecasts is baked into the price, leaving more room for a downside surprise.

3) Usage of funds

Some members of the Frankfurt-based institution are unsure if the bank should deploy all the pledged funds. Some see the full extent of the bond-buying scheme as a “bazooka” – a tool meant to calm markets, but not to be used.

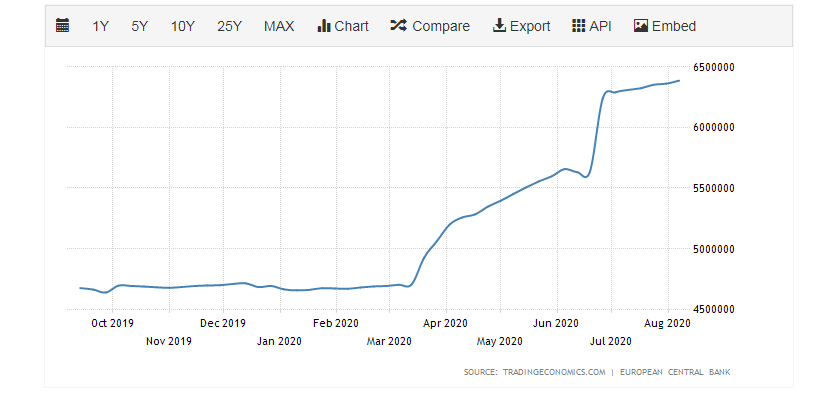

The bank rushed to print money early in the crisis, and the pace has recently slowed down:

Source: Trading Econmics

Reporters are set to ask Lagarde about the progress of the program and if it needs to be scaled down. She will likely reiterate that the program is set to continue advancing as planned.

Contrary to the pre-pandemic era, more money printing means additional funds for governments to spend – thus positive for the currency. If Lagarde pays lip service to the hawks and suggests some funds will stay within the ECB’s vaults, the euro could fall.

On the other hand, opening the door to more bond-buying – well before the program expires – would boost the common currency.

The most likely scenario is for Lagarde to say that no changes are expected. The bias is neutral in this case.

Conclusion

The ECB is set to leave rates unchanged but its comments on the exchange rate, new forecasts, and any comment about future bond-buying are all set to rock EUR/USD.