An announcement on Quantitative Easing by the ECB seems imminent after recent comments from the Bank’s chiefs, including Draghi, and after the removal of the Swiss peg.

The team at Credit Suisse provides an in-depth analysis and various scenarios for the big event on January 22nd:

Here is their view, courtesy of eFXnews:

In the run-up to the ECB’s first meeting this year on 22 January, Credit Suisse outlines the following scenarios of the most likely outcome.

1- We attach a high 70% probability to QE in the form of sovereign bond purchases being announced next Thursday given the amount of ECB speak preparing the ground throughout the holiday season and in the run-up to the January meeting.

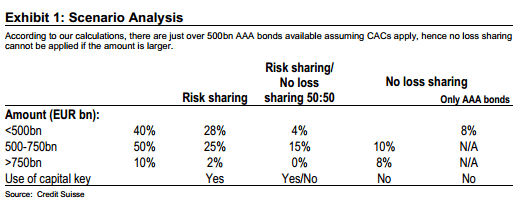

2- As in the past and to start with, we expect the ECB’s QE announcement to be merely accompanied by broad guidelines rather than all the details. But given the time the ECB has had to work out scenarios, we would expect proper bond buying to start before mid-February.

3- We anticipate the broad guidelines to provide a sense of size and shed light on the risk sharing question which reportedly is being actively discussed within the Governing Council. Our base scenario, to which we attach a probability of 50%, is the ECB announcing QE amounting to € 500-750 bn of sovereign investment grade bonds. The ECB might not spell out clearly an amount but merely reiterate its intention to expand its balance sheet by €1 tn. In this context, the ECB could state that sovereign bond purchases will be carried out to add to existing measures. Since, as we have highlighted in the past, existing measures are hardly more than offsetting an otherwise shrinking ECB balance sheet as 3-year LTROs and SMP bonds mature, this leaves the amount in the €500-750bn bracket. We also expect the ECB to leave the door open to do more if needed.

4- Our base scenario also attaches a 50% probability to this €500- 750 bn bracket to conform with the ECB’s understanding of the euro area monetary policy operation which entails sharing losses and/or profits according to the capital key.

5- We attach the lowest probability, merely 10%, to the ECB surprising to the upside on the amount, that is purchases exceeding €750 bn or even €1 tn or more.But we also believe that there will be an inverse relationship between the ECB sharing risk and the amount of purchases involved. The lower the amount, the higher the likelihood that losses will be shared according to the capital key whereas the probability of no loss sharing or doing a more messy split partly sharing risk and leaving the rest to national central banks (NCBs) and thus national governments increases the higher the amount.

6- Drawing it all together, we conclude that the ECB compromising on size rather than risk would be preferable, although within that scenario the door to do more is hopefully left wide open. We believe the market response would be more positive if the ECB embarks on a proper euro area monetary policy operation entailing the sharing of risk rather than singling out periphery countries by not willing to compromise. The latter would be hardly conducive to successfully starting the longawaited euro area QE.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.