The Draghi show is back and this time with new forecasts. Here is the preview from Danske:

Here is their view, courtesy of eFXnews:

We expect the ECB to maintain its patient stance at the meeting this week and not send any new signals about more easing. An important argument for the ECB to remain patient is that financing conditions have improved following the easing measures announced at the beginning of March. The latest easing of financing conditions is seen in lower real swap rates due to higher near-term market-based inflation expectations.

The minutes from the latest ECB meeting in April clearly confirmed that the ECB is in implementation mode. It stated that patience was needed for the measures to fully unfold and ‘focus of attention had very much shifted to the implementation details of both the corporate bond purchases and the TLTRO-II’. Importantly, the ECB argues that it is adding additional accommodation in June, due to the first TLTRO II auction and the beginning of purchases of corporate bonds.

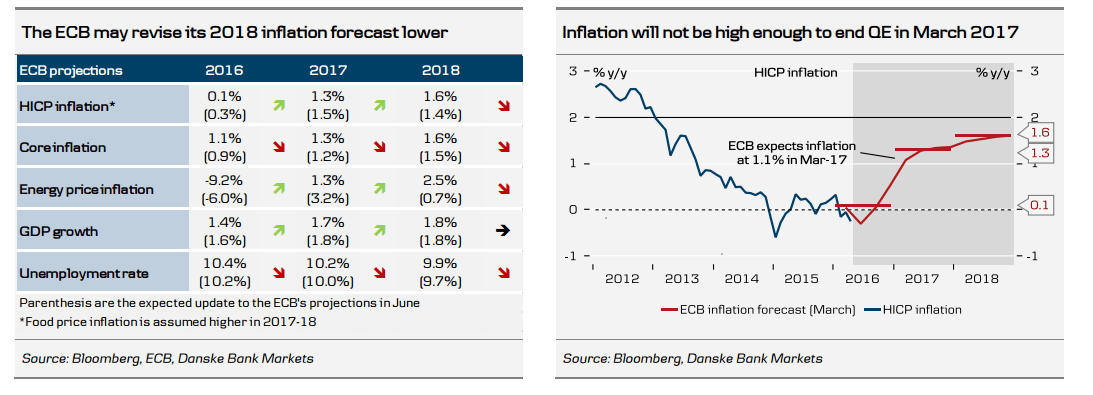

The ECB will publish updated growth and inflation forecasts at the meeting this week. We look for an upward revision to the ECB’s projection for headline inflation in 2016-17 due to the higher oil and food prices, but the core inflation forecast will in our view be revised lower over the entire forecast horizon. The ECB argues that core inflation will rise as the labour market improves, but we believe wage pressure will stay modest for some time due to labour market slack, while the stronger effective euro will also be a headwind.

Notably, the ECB might revise its 2018 inflation forecast lower. This should follow as the forward oil price has increased more in 2016 and 2017 than in 2018, implying the inflation rate for energy prices is likely to be lower in 2018. A lower inflation forecast at the end of the forecast horizon will not be welcomed at the ECB, but we do not expect it to be enough to trigger a more dovish stance as the ECB awaits the impact of the deliver easing.

From a market perspective, expectations are very low with a zero probability of a 10bp deposit rate cut at the upcoming meeting. This is down from a 20% probability of a June cut after the March meeting, where Draghi was interpreted as closing the door to additional rate cuts. We stick to our view that the ECB will remain side-lined in the global currency war and not cut policy rates further.

Focus is also likely to turn to the situation in Greece as the ECB may reinstate the waiver thereby accepting Greek bonds as collateral again. This would allow Greek banks to borrow from the ECB against their holdings of domestic sovereign bonds despite their junk ratings with all rating agencies. Borrowing from the ECB offers a cheaper alternative to borrowing at the Greek central bank’s emergency liquidity assistance window.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.