Treasury yields continue to move higher, closing above the 2% threshold and notching up relatively high yield differentials. The 2.20% level has not been seen in more than 18 months despite a declining global growth story.

Although the US economy has gained enough traction to be able to withstand higher long term yields, the European economy and the Japanese economy will need lower global yields to allow their economies to gain a foot hold.

US yields which seem to be the driver of the US dollar have made a 52-week high and are poised to test resistance levels near 2.40, which were the highs made in mid-2011. A move above these levels would likely be a function of continuing improvement in the US economy, specifically in the jobs sector which at the moment continues to be relatively fragile. Support on the US 10-year yield is seen near the 100-day moving average at 1.80%.

Increasing US yields is a problem for the US central bank. The goal of quantitative easing is to push long term yields lower and spur on growth through business lending at low rates. The recent move above 2% has generated a backup in mortgage rates which reduces interest in home purchases.

Article by Marcus Holland from Forex Training.

The climb in the US 10-year yields has not been matched by European yields. Although the German bund has seen a decline in prices and an increase in yield, the differential between the two countries yields has increased to more than 70 basis points which is the highest differential between the two countries seen since 2010. The next level of support for the differential is seen near 85 basis points. The yield differential has not been as exaggerated for the JGB, but the change relative to the Australian dollar and the Canadian dollar has been the driving force behind the dollar’s advance against these common wealth currencies.

Early next week the US will report a number of economic data points that will shed light on the health of the US economy, which will likely drive yields and the direction of the US dollar. Next week the US will report ISM manufacturing, ADP employment and the BLS unemployment report. The non-farm payroll report released on Friday June 7 will be the key release for currency traders.

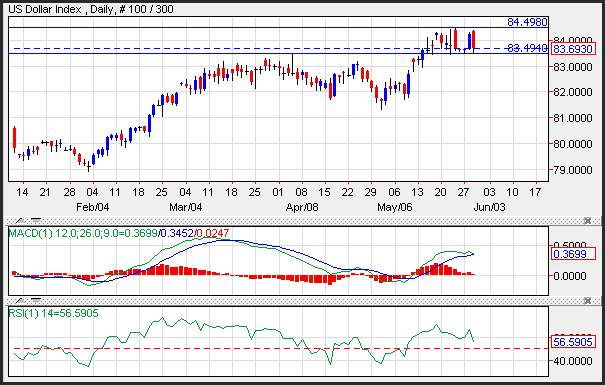

The dollar index, which is a proxy for dollar currency trading has been trading in a 1 big figure range over the past two weeks. Higher yields should assist in pushing the index above resistance near the 84.50 level. Momentum on the dollar index has been drained by the recent consolidation with the MACD (moving average convergence divergence) index printing near the zero level. The RSI (relative strength index) is printing near 56, which is in the middle of the neutral range reflecting the recent consolidation.