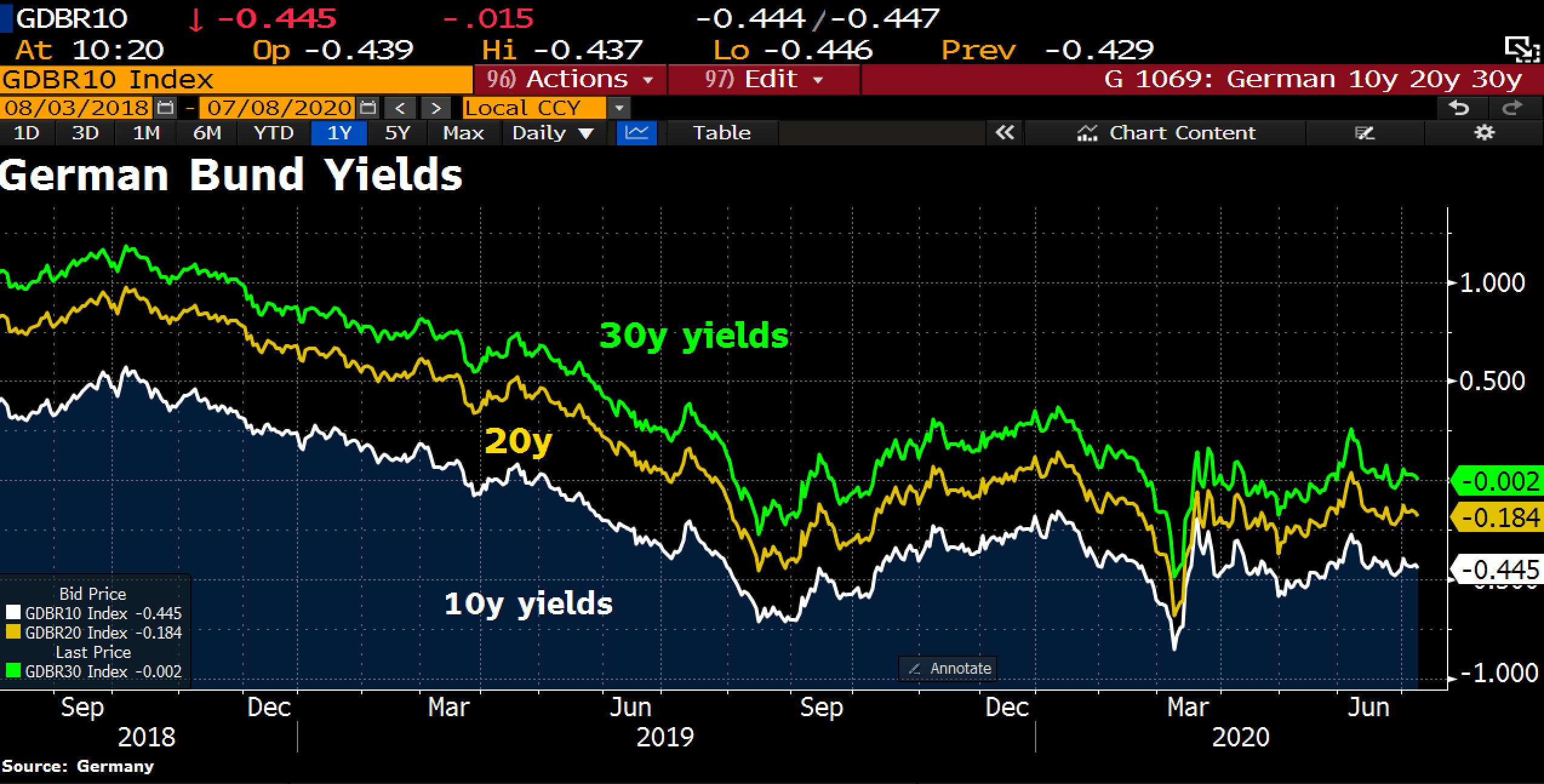

German 30-year bond yield turned negative on Monday after spending a better part of the previous four weeks trading above the zero percent mark.

With the longer duration yield’s drop below zero, the entire yield curve is now in negative territory, as noted by popular macro analyst Holger Zschaepitz. Further, the difference between the cost of borrowing for Italy or Greece compared with Germany has fallen to levels seen before governments imposed the coronavirus lockdown restrictions, according to the Wall Street Journal.

Both data indicate that the European Central Bank has effectively set up a backstop to the Eurozone’s debt market.

The central bank is buying 1.35 trillion euros of assets in the region as part of its pandemic emergency purchase program (PEPP) in addition to the bond-buying program of 20 billion euros per month. Berenberg European economist Florian Hense thinks that the ECB could expand its bond-buying program by a further 1 trillion euros over the next two to three years, according to CNBC.

German yield curve first fell into the negative territory in early August 2019. Back then, the escalating trade tensions between the US and China had forced investors to pour money into safe havens like the German government bonds.