Draghi decided to keep us in suspense towards the December decision. What can we expect from the high stakes event? Here is the view from Goldman Sachs:

Here is their view, courtesy of eFXnews:

What we expect from the ECB to announce on 8 December?

1- The ‘stock effect’: QE extended by 9 months, from March 2017 to December 2017. We think our views are close to the market consensus on this dimension. Ultimately, we expect bond purchases to continue to the end of 2018. It is difficult to gauge what expectations are for this distant horizon and we doubt the ECB will pre-commit at this stage. We expect the existing language of “or beyond, if necessary”, and “in any case until the Governing Council sees a sustained adjustment in the path of inflation consistent with its inflation aim” to be preserved.

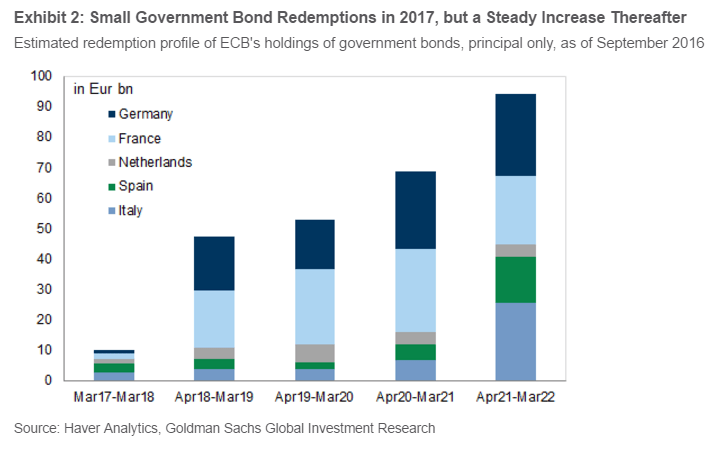

2- The ‘flow effect’: the monthly purchases of government bonds to remain close to the current run-rate of EUR60bn, at least into the first half of 2017. As reported further below, the reinvestment of maturing government bonds really kicks in from 2018 and beyond, on our estimates, reaching EUR75-100bn per annum by 2021-22. Technical information on how the re-investments of the principal will be conducted may also be provided in December.

3- Scarcity constraints: The ECB could introduce several changes to the parameters that guide QE – each of which has a different implication for scarcity and the relative pricing of EMU bonds. According to the available polls, the majority of market participants expect the ECB to resort to buying bonds yielding below the deposit rate (which, as we reported last Friday, would double the eligible amount of German bonds and substantially reduce the scarcity problem), and absorbing a larger share (i.e., up to 50%) of non-CAC securities. We are instead of the view that departing from the current allocation of sovereign purchases according to the ECB’s capital key will likely have to do the heavy lifting to address scarcity. Given the political sensitivity of such an approach, we think it will be implemented below the radar as a technical operational adjustment rather than with great fanfare. Ours, as we understand it, is a minority view in the mark.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.