We usually focus on fundamentals and also on technical analysis, but a lot also depends on the flows.

The team at CIBC examines the flows in EUR, AUD and CAD, and reach interesting conclusions:

Here is their view, courtesy of eFXnews:

The following are the weekly outlooks for the CAD, and AUD as provided by CIBC World Markets.

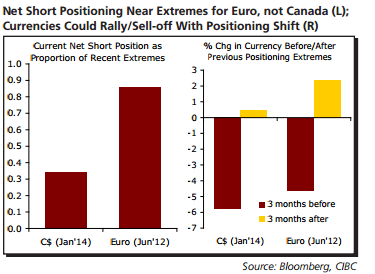

CAD, EUR: Extreme and Not so Extreme Shorts. Despite all of the apparent negativity surrounding the Canadian dollar in recent months, net short positions against the currency aren’t actually that stretched at the moment. If sentiment did soar further, towards extremes last seen in early 2014, the loonie could be headed for another turn weaker. The same can’t be said of the euro, though.

While ongoing uncertainty surrounding Greece could add to downside pressure in the near-term, net short positioning against the single currency is already close to the extremes witnessed in mid-2012. If negative sentiment eases and growth starts to show signs of life again, the euro could be trading slightly stronger by yearend.

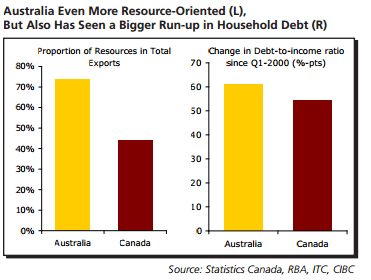

AUD: Policy Balancing Down-Under. The RBA faces an even more precarious balancing act than the BoC as it tries to navigate the economy through the commodity crisis. Australia’s exports are even more sensitive to resources than Canada’s, suggesting an even greater hit to the economy from lower prices and slower global demand.

But alongside that, Australia’s housing market may be even further into bubble territory, with the debt-to-income ratio having risen faster than Canada’s since the start of the millennium.Just like here, the RBA has concluded that risks from the former are greater than the latter, at least in the near-term, and markets expect that last week’s rate cut will be followed by more. Such speculation could add further downside pressure to the Aussie.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.