EUR/USD ended Q3 around the same place it started it. Q4 could be different.

The team at Bank of America Merrill Lynch have forecasts and targets for EUR/USD:

Here is their view, courtesy of eFXnews:

The following is Bank of America Merrill Lynch’s comprehensive October outlook for the EUR including the single currency’s current major themes, strategies, forecasts, and risks.

Themes: waiting for the first Fed hike and ECB QE2. The Fed surprised markets by not hiking in Sept and by delivering a dovish message. The market was expecting the Fed to be on hold, but was also expecting a relatively hawkish tone. By emphasizing the external environment, the US inflation outlook and the need for even more improvements in the labor market, the Fed’s message was that things had to get better, both domestically and externally, before hiking. This could take a while. In the meantime, the ECB has started preparing the ground for QE2. We expect the ECB to announce as early as October that they will continue with QE even after September next year. They have already admitted that they will miss their medium-term inflation target based on the current QE, suggesting that they need more policy easing. Although the ECB does not target the exchange rate directly, indirectly they do, as they cannot afford a strong currency at a time when they are missing their inflation target.

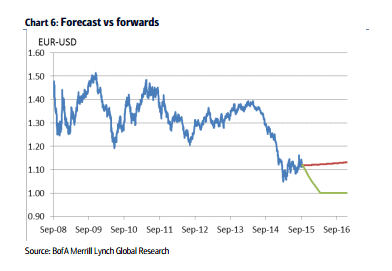

Forecasts: Parity, next year. We revised our EUR/USD end-2015 projection to 1.05 from parity after the Fed meeting. Our projection assumes that the Fed will start hiking rates in December and the ECB will announce that it will extend QE for after Sept 2016. In this scenario, we would expect EUR/USD to reach parity next year, most likely by the end of Q1.

Risks: Fed, ECB, China. Our projections have upside risks in the short-term (this year), but we feel more confident about them in the longer term (next year). If the Fed does not hike at all this year and the ECB does not commit to extend QE yet, EUR/USD could appreciate above 1.15. However, this will not be sustainable. 1/ It will be well above the ECB’s FX assumptions in its inflation projections (EUR/USD at 1.12). 2/ The ECB has in the recent past talked the Euro down whenever EUR/USD crossed 1.15, as such a level increases risks to its inflation path. And 3/ such a EUR/USD level would be above our estimate of equilibrium, which is 1.16, and would be inconsistent with the diverging US and Eurozone business cycles.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.