- The cross flirts with the 21-day SMA near 0.8580.

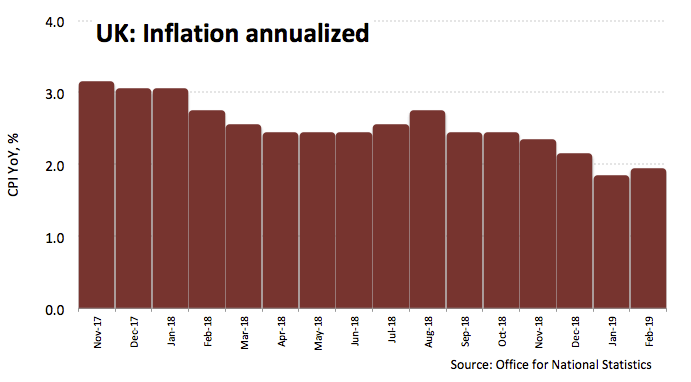

- UK CPI rose 1.9% YoY, bettering consensus.

- PM T.May will formally ask the EU for an extension of Article 50.

The softer tone in the Sterling is now helping EUR/GBP to advanced to daily highs in the 0.8580 region, where lies the 21-day SMA.

EUR/GBP up on UK inflation

The European cross picked up extra pace despite UK inflation figures surprised to the upside during February. In fact, consumer prices tracked by the CPI rose 0.5% MoM and 1.9% from a year earlier.

However, the ongoing uncertainty around Brexit keeps the sentiment around GBP somewhat depressed today after recent news cited the House of Commons will not vote on a third Brexit plan this week (as per comments from Speaker J.Bercow) and PM Theresa May is expected to formally ask the EU for an extension of Article 50.

What to look for around GBP

The British Pound came under renewed selling pressure this week after another meaningful vote on May’s Brexit plan has been postponed for the next weeks. In addition, PM Theresa May is expected to formally ask the EU for an extension of the Brexit deadline (March 29). In this regard, consensus among investors appears to favour a short-term extension to June 30.

EUR/GBP key levels

The cross is gaining 0.35% at 0.8583 facing the next hurdle at 0.8594 (high Mar.18) seconded by 0.8675 (high Mar.11) and finally 0.8726 (55-day SMA). On the flip side, the breach of 0.8471 (2019 low Mar.13) would expose 0.8402 (monthly low Feb.22 2017) and then 0.8382 (monthly low May 10 2017).