- EUR/GBP has moved a little higher on Friday but is still not far from recent multi-month lows.

- The pair has been weighed by the UK’s comparatively swift vaccination efforts in January and amid EU vaccine delivery delays.

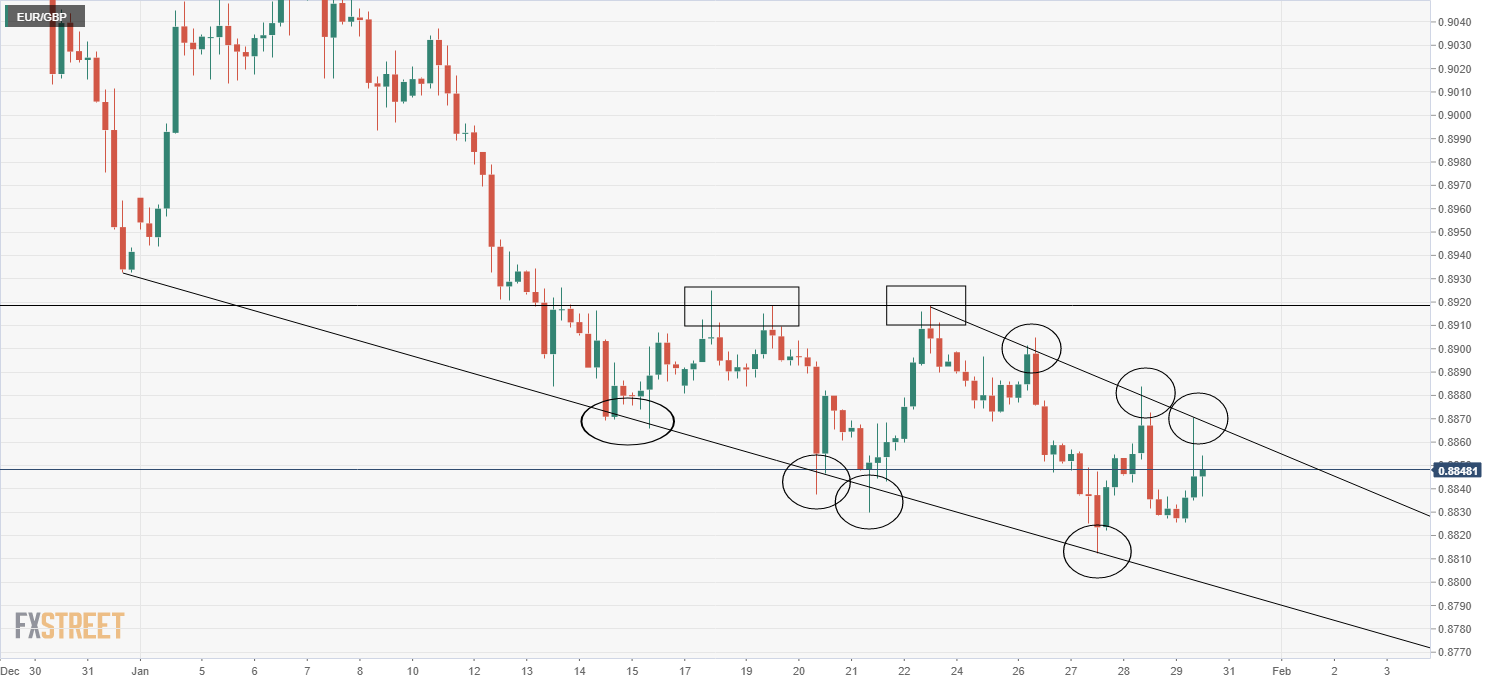

EUR/GBP has moved higher on Friday and currently trades around the 0.8850 mark, having failed to challenge recent multi-month lows set earlier on in the week of below the 0.8820 mark. In the grand scheme of things, the pair is a little higher on the day, it is still within striking distance of multi-month lows and from a technical perspective, a turnaround in the pair is unlikely to materialise any time soon; a downtrend linking the 22, 26, 28 and 29 January highs continues to act as a cap to the price action, while an even longer-term downtrend linking the 31 December, 14, 20 and 21 January lows continues to act as a floor for the price action. As long as EUR/GBP remains within this downwards trend channel, its bearish bias remains in place.

Driving the day

In terms of fundamental news/developments out of the UK, there isn’t too much of note aside from some promising data on the nations Covid-19 reproduction rate (i.e. the number of people on average each Covid-19 infected person infects); the UK’s Covid-19 R estimate range was revised to 0.7-1.1 from 0.8-1.0, while in London it was lowered to 0.6-0.9 from 0.7-0.9. The nation continues to vaccinate at population at an impressive speed by international comparison, a notion which likely support GBP on the week (thus helping EUR/GBP drop 0.4%).

Meanwhile, there are many more data points, news and headlines to digest related to the Eurozone. The first one to may have particular importance for the EUR/GBP pair; EU vaccine makers must not seek permission from the authorities before they are allowed to export vaccines (as expected). That means the EU will now have the power to prevent Pfizer’s factory in Belgium from fulfilling its contractual agreement with the UK on the ground that the EU needs those vaccines instead. If the EU does disrupt UK vaccine supply, this could erode the UK’s comparative vaccination lead over the EU, thus supporting EUR/GBP.

Sticking with pandemic news, in a further blow the EU’s vaccination efforts, Moderna is now also delaying deliveries to Italy, France and Poland. Meanwhile, the European Medical Agency has approved the use of AstraZeneca’s vaccine.

Elsewhere, German, French and Spanish preliminary GDP numbers for Q4 2020 both surprised to the upside, offering some limited respite to the euro against USD and GBP, and German employment data for January was also stronger than expected. Meanwhile, further ECB commentary had a less dovish tilt; rate cut discussions have been marginal in policy talks, an ECB source said, in an apparent effort to push back on sources saying earlier in the week that markets were underestimating the prospect for a rate cut.

EUR/GBP four hour chart