- EUR/GBP remains on the recovery mode.

- The immediate falling trend line can probe upside beyond the triangle’s break.

- Sellers can target April month low on the fresh downside.

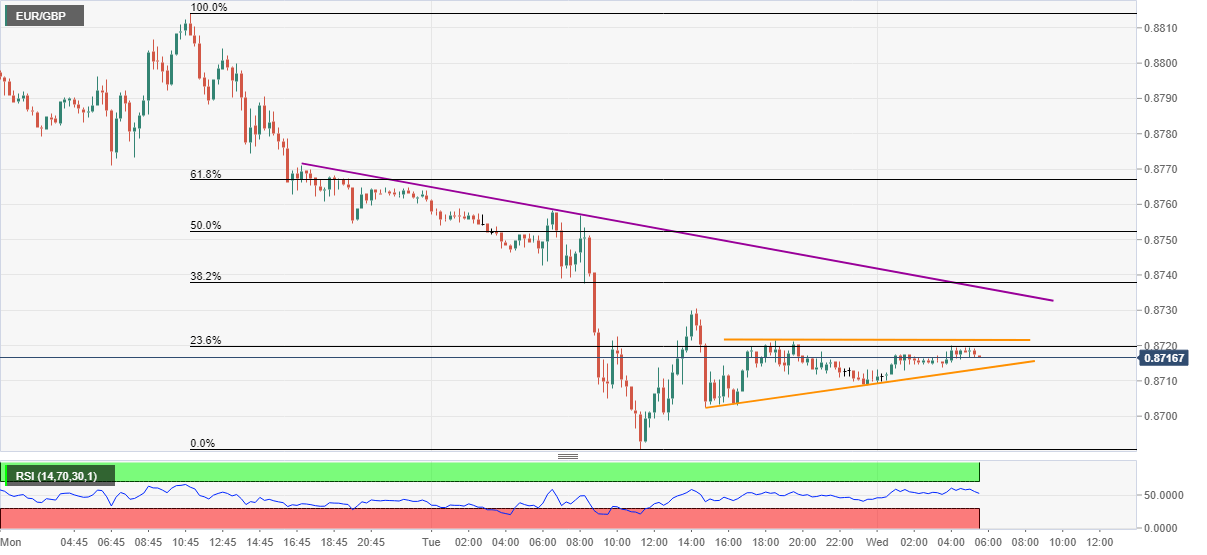

EUR/GBP stays modestly bid to 0.8720, up 0.05%, while heading into the European session on Wednesday. In doing so, the pair stays inside a short-term triangle.

Not only the aforementioned triangle’s resistance line around 0.8722, a falling trend line from Monday’s US session, currently near 0.8737, also checks the buyers.

In a case where the EUR/GBP prices manage to cross 0.8737 mark, 61.8% Fibonacci retracement of the current week’s fall, around 0.8767 will be on the bulls’ radars.

Meanwhile, a downside break of the triangle’s support, at 0.8713 now, can quickly drag the quote to the previous month’s low near 0.8690.

Additionally, a sustained south-run past-0.8690 becomes the key for the bears to target March bottom near 0.8595.

EUR/GBP 15-minute chart

Trend: Sideways