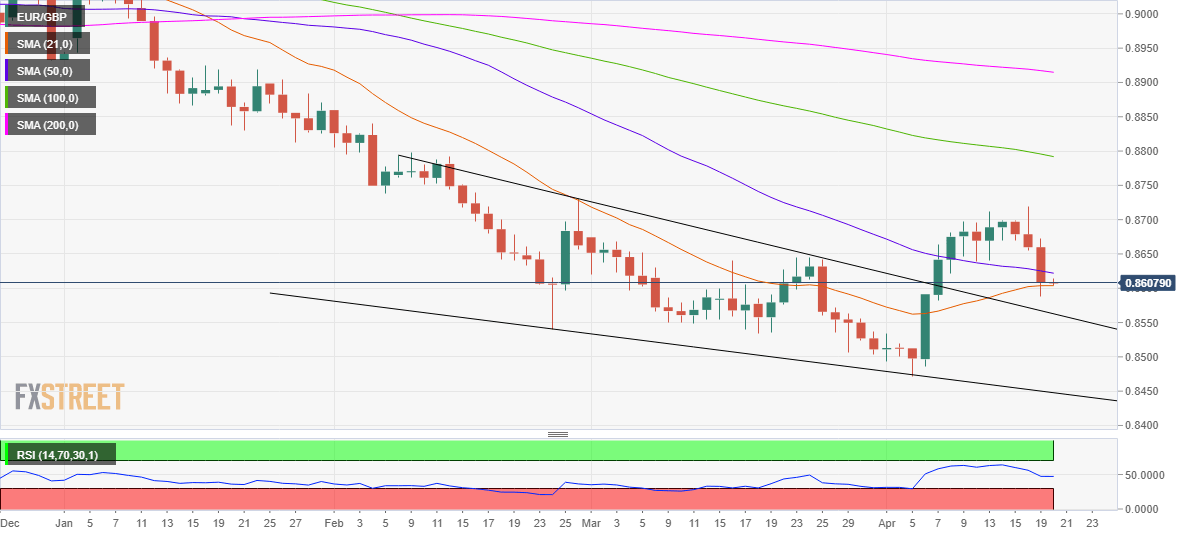

- EUR/GBP stalls the sell-off but not out of the woods yet.

- Falling wedge resistance now support eyed on the 1D chart.

- RSI remains bearish and calls for more downside.

EUR/GBP has paused its three-day losing streak, attempting a minor bounce while defending the critical short-term 21-daily moving average (DMA) support at 0.8604.

Meanwhile, the bearish 50-DMA caps the immediate upside at 0.8622. The 14-day Relative Strength Index (RSI) has turned flat but holds below the midline, which keeps the sellers hopeful.

Therefore, a sustained move below the 21-DMA could call for a test of the falling wedge resistance now support at 0.8563.

Note that the move higher from the wedge breakout on the daily chart, which appeared earlier this month, ran out of steam near the 0.8715 region. Ever since the price has been on a downtrend.

The next relevant support is aligned at 0.8550, the psychological level.

EUR/GBP daily chart

On the flip side, recapturing the 50-DMA barrier could expose the 0.8700 mark once again.

A break above which the recent top of 0.8719 could be retested.

EUR/GBP additional levels to watch