- EUR/GBP held steady just below two-and-half-week highs touched on Wednesday.

- Move beyond 200-period SMA on the 4-hourly chart would prompt fresh buying.

The EUR/GBP cross lacked any firm directional bias and seesawed between tepid gains/minor losses through the early European session. The cross was last seen trading around the 0.8630 region, just below two-and-half-week tops touched in the previous day.

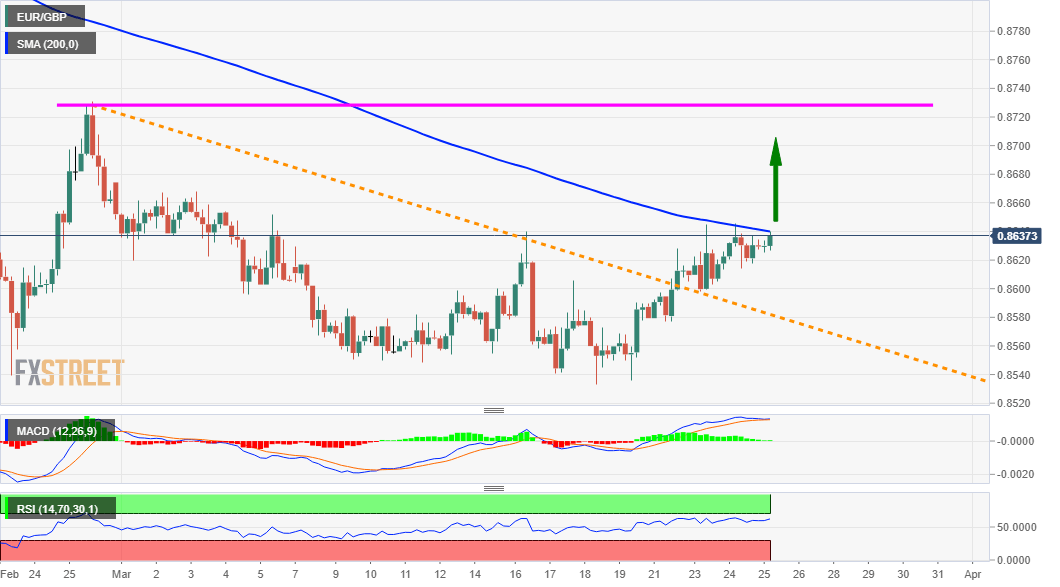

Looking at the technical picture, the recent bounce from over one-year lows stalled near a resistance marked by 200-period SMA on the 4-hourly chart. The mentioned barrier, currently around the 0.8645 region should now act as a key pivotal point for short-term traders.

Meanwhile, oscillators on hourly charts have been gaining positive traction but are yet to confirm a bullish bias on the daily chart. This, in turn, warrants some caution for aggressive bullish trades amid a spike in COVID-19 infections and pandemic-related lockdowns in Europe.

That said, a sustained move beyond the said hurdle has the potential to push the EUR/GBP cross beyond monthly swing highs, around the 0.8665-70 region. Bulls might then aim to reclaim the 0.8700 mark before eventually darting to retest the 0.8730-35 supply zone.

On the flip side, a short-term descending trend-line resistance breakpoint, around the 0.8600 mark now seems to protect the immediate downside. Any further decline could be seen as a buying opportunity and remain limited, rather find decent support near the 0.8555 area.

EUR/GBP 4-hourly chart

Technical levels to watch