- EUR/GBP takes offers near intraday low, extends Friday’s losses.

- 50-bar SMA guards immediate upside, eight-day-old resistance line become the key.

- Bears eye monthly low but 0.8865/60 can offer intermediate halt.

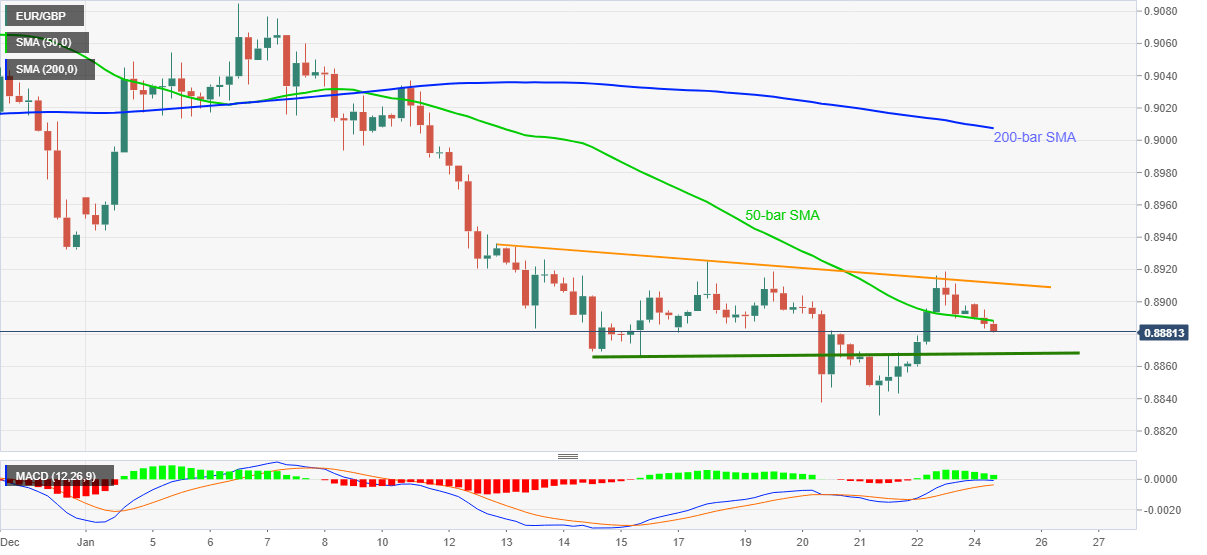

EUR/GBP stands on a slippery ground near the intraday low of 0.8882, down 0.14% on a day, as traders in Brussels prepare for Monday’s session. In doing so, the quote stretches Friday’s U-turn from a short-term descending resistance line from January 13.

Recently favoring EUR/GBP bears could be the downside break of 50-bar SMA as well as receding strength of the bullish MACD.

As a result, EUR/GBP sellers are likely targeting multiple supports around 0.8865/60 ahead of challenging the monthly low, also the lowest since May 2020, near 0.8830.

During the pair’s further weakness past-0.8830, the 0.8800 threshold will gain the market’s attention.

Meanwhile, an uptick beyond the 50-bar SMA level of 0.8888 should challenge the immediate trend line resistance, at 0.8910 now.

However, EUR/GBP bulls are less likely to be convinced unless witnessing sustained trading above 200-bar SMA, currently around 0.9010.

EUR/GBP four-hour chart

Trend: Bearish