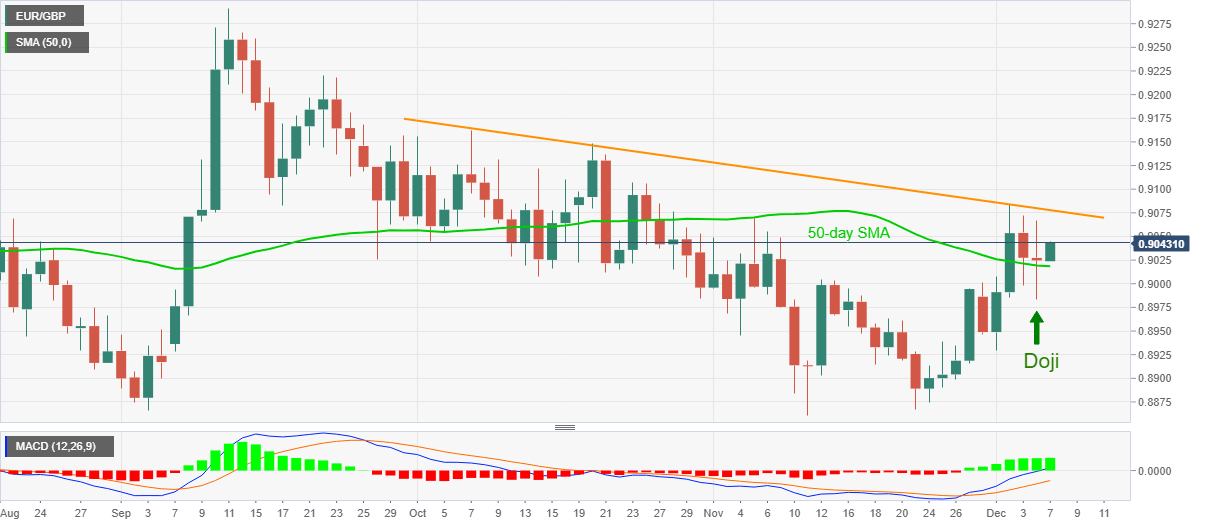

- EUR/GBP snaps three-day losing streak after marking a trend reversal candle.

- Bullish MACD, sustained trading above 50-day SMA also favor buyers.

EUR/GBP rises to 0.9042, up 0.20% intraday, while heading into Monday’s European session opening. In doing so, the pair justifies Friday’s bullish doji while regaining above 50-day SMA.

Considering the pair’s successful trading above the key SMA, as well as recent candlestick formation and MACD, EUR/GBP buyers are again targeting the descending trend line from October 07, at 0.9078 now.

However, a daily closing beyond the same will need to refresh the monthly high above 0.9083, also cross the 0.9100 round-figure, to eye the October’s top surrounding 0.9165.

On the downside, a daily closing below the 50-day SMA level of 0.9018 may catch a breather around 0.9000 psychological magnet.

During the quote’s weakness past-0.9000, 0.8930 and the previous month’s low near 0.8861 could return to the charts.

EUR/GBP daily chart

Trend: Further upside expected