- EUR/GBP extends weakness on breaking three-day-old support line.

- Short-term falling channel favors bears, 200-bar SMA adds to the upside barriers.

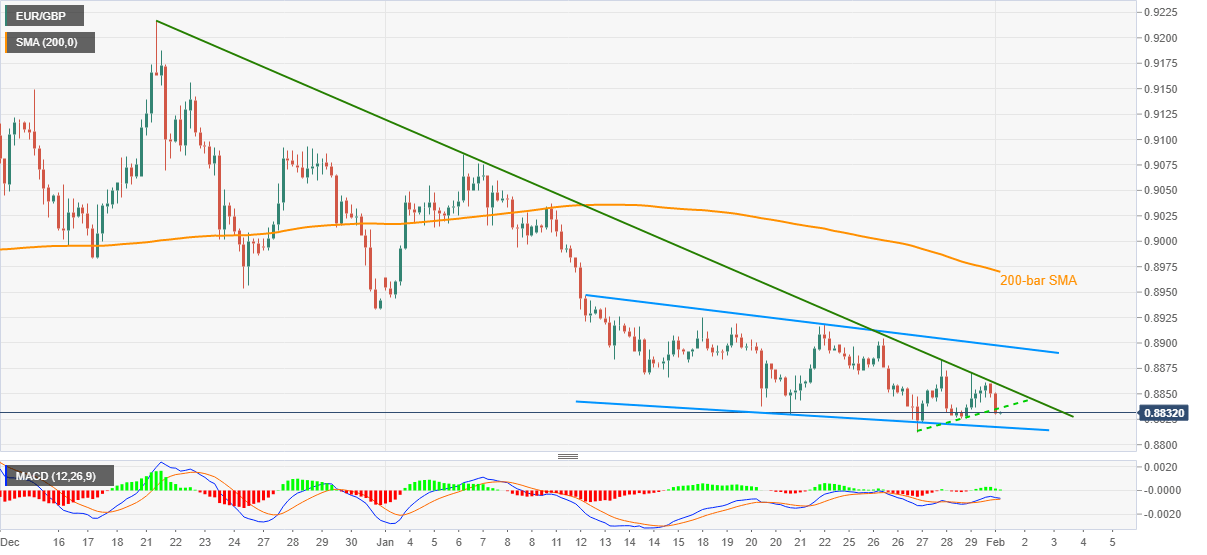

EUR/GBP remains depressed below 0.8850, currently down 0.30% around 0.8830, ahead of Monday’s European session. While a short-term falling channel since January 12 portrays the pair’s downside momentum, a recent break of immediate support line extended the quote’s declines ahead of the German Retail Sales for December and final figures of the UK Manufacturing for January.

Considering sluggish MACD conditions and sustained trading below a falling trend line from December 21, EUR/GBP is likely to remain pressured towards testing the stated channel’s support line, at 0.8817 now.

However, any further weakness will be tamed January’s low, also the lowest since May 2020, around 0.8810. It should be noted that the 0.8800 round-figure offers an extra filter to the south.

Alternatively, an upside clearance of the multi-day-old resistance line, currently around 0.8860, will eye for the upper line of the channel nearing the 0.8900 threshold.

In a case where EUR/GBP bulls keep the reins past-0.8900, the 200-bar SMA level of 0.8970 and the 0.9000 round-figure will be the key to watch.

EUR/GBP four-hour chart

Trend: Bearish