- EUR/GBP eases from highest in three days as bulls await fresh push.

- Break of short-term resistance line, now support, bullish MACD and strong RSI conditions favor bulls.

- Sellers need to refresh monthly low for fresh entries.

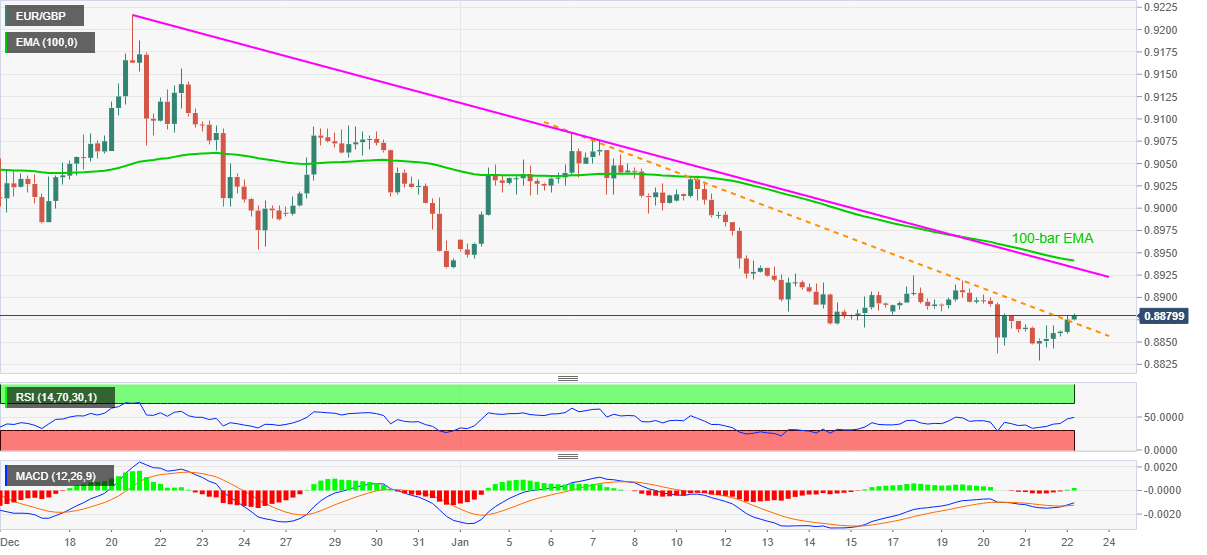

EUR/GBP eases from the intraday top to 0.8879 while heading into Friday’s European session. In doing so, the quote prints 0.22% gains on a day, the first in the last three days, while keeping the upside break of a descending trend line from January 06.

Not only immediate resistance line breakout, now support, but bullish MACD signals and upbeat RSI line also suggests further upside of EUR/GBP prices.

As a result, a one-month-old falling trendline and lows marked during December 31, around 0.8930, followed by 100-bar EMA near 0.8940, lures the EUR/GBP buyers for now.

However, any further upside won’t hesitate challenging the monthly top surrounding 0.9085 wherein the 0.9000 threshold can offer an intermediate halt during the rise.

Alternatively, the pair’s drop back below the immediate support line, at 0.8870 now, will attack the monthly low, also the lowest since May 2020, around 0.8830.

Should EUR/GBP bears keep the helm below 0.8830m, the 0.8800 round-figure and April 2020 low near 0.8670 can come back to the radars.

EUR/GBP four-hour chart

Trend: Further upside expected