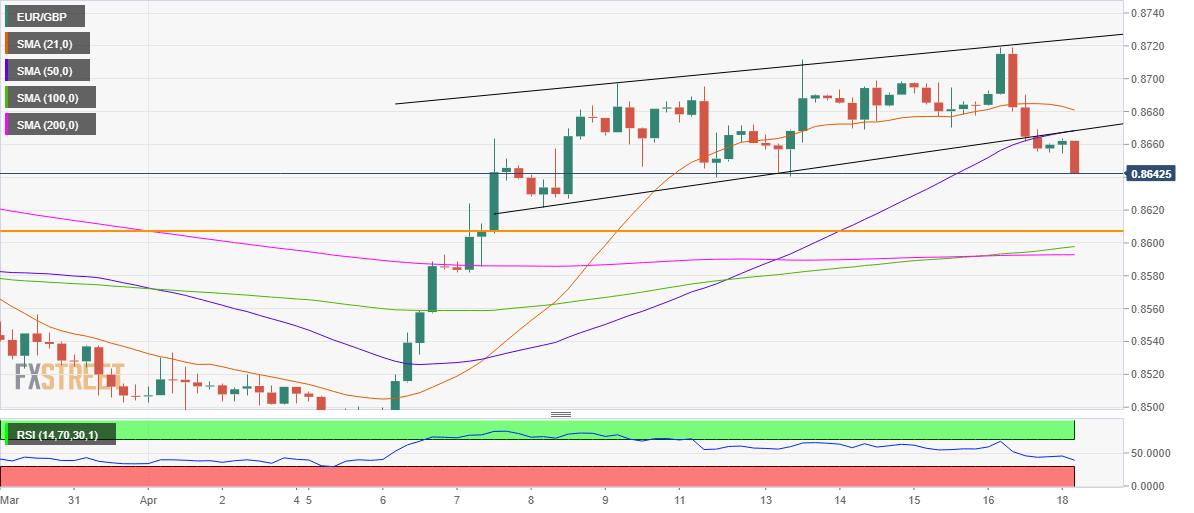

- EUR/GBP’s sell-off likely to extend amid rising channel breakdown on the 4H chart.

- A test of the critical support at 0.8605 remains on the cards.

- RSI points south, outlook appears bearish in the short term.

EUR/GBP is nursing losses around mid-0.8600s in Monday’s Asian trading, having felt the heat from steep losses in the EUR/USD pair, as the US dollar rebounds amid broad risk-aversion.

Meanwhile, the Cable remains on the defensive but resilient so far, in the wake of resurgent US dollar demand, as the UK re-opening and vaccine optimism remains supportive of the pound.

The focus this week remains on the US infrastructure spending bill and the European Central Bank (ECB) policy decision.

From a near-term technical perspective, the path of least resistance for EUR/GBP appears to the downside, especially after the cross confirmed a rising channel breakdown on the four-hour chart in the US last session.

After a brief downside consolidation in early dealing this Monday, the bears have resumed the declines, as the immediate support is now envisioned at 0.8605 – the horizontal (orange) trendline.

Further south, a confluence of the 100 and 200-simple moving averages (SMA) around 0.8590 could emerge as crucial support.

The Relative Strength Index (RSI) is edging towards the oversold territory, currently at 39.11, suggesting that there is more scope to the downside.

EUR/GBP four-hour chart

Alternatively, any recovery attempts could meet strong resistance at 0.8668, the intersection of the rising wedge support and upward-sloping 50-SMA.

The next barrier for the bulls is aligned at the bearish 21-SMA at 0.8806. Acceptance above the latter is critical to unleashing further recovery gains.

EUR/GBP additional levels to watch