- EUR/GBP keeps the area of multi-week highs near 0.8950.

- GBP loses further ground on lower-than-estimated CPI results.

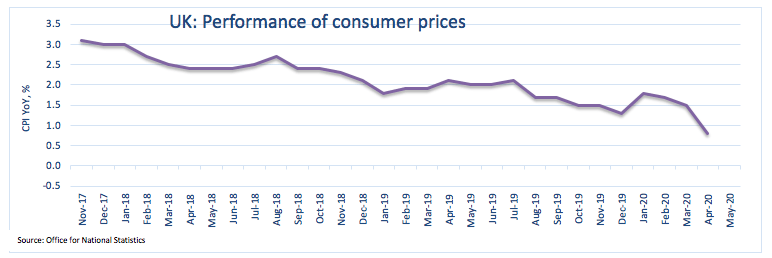

- UK CPI contracted 0.25 MoM in April and 0.8% YoY.

Further selling bias in the British pound is motivating EUR/GBP to resume the upside and leave behind Tuesday’s down tick.

EUR/GBP bid after UK data

EUR/GBP is back to the positive territory in the middle of the week, regaining the upper end of the week around 0.8950, levels last visited in late March.

The sterling saw its downside pressure exacerbated today after UK inflation figures came in short of expectations during last month. In fact, consumer prices contracted at a monthly 0.2% and rose 0.8% from a year earlier (nearly halving from March’s gain 1.5% gain).

Closer to home, EMU’s Current Account surplus shrunk to €27.4 billion in March ahead of the final inflation figures tracked by the CPI for the month of April.

On the UK-EU trade front, the scenario is getting worse by the day after the UK said the EU is offering a ‘low level’ trade deal, all amidst rising bets that the UK will not ask for an extension of the transition period (deadline on June 30th) that ends on December 31st.

What to look for around GBP

The British Pound is the worst performing G10 currency so far this month. Indeed, the quid appears to have met quite a significant barrier above the 1.2600 mark vs. the greenback (200-day SMA) and the 0.8660 area vs. the euro (April lows). Moving forward, the sterling is expected to remain under pressure against the backdrop of rising scepticism over the handling of the coronavirus crisis by the UK government and the potential re-opening of the economy, all amidst the forecasted deep recession the country is expected to face in the first half of the year. Further weakness also stems from the probability that the UK would not ask for an extension of the transition period, opening the door to hard UK-EU trade negotiations. In addition, the sterling risks extra downside pressure on the tangible probability that the BoE could pump in extra stimulus in the next months, even the implementation of negative rates.

EUR/GBP key levels

The cross is up 0.36% at 0.8946 and faces the initial hurdle at 0.8960 (monthly high May 18) followed by 0.9019 (monthly high Oct.20 2019) and finally 0.9324 (2019 high Aug.12). On the other hand, a breach of 0.8853 (55-day SMA) would expose 0.8708 (200-day SMA) and then 0.8670 (monthly low Apr.30).