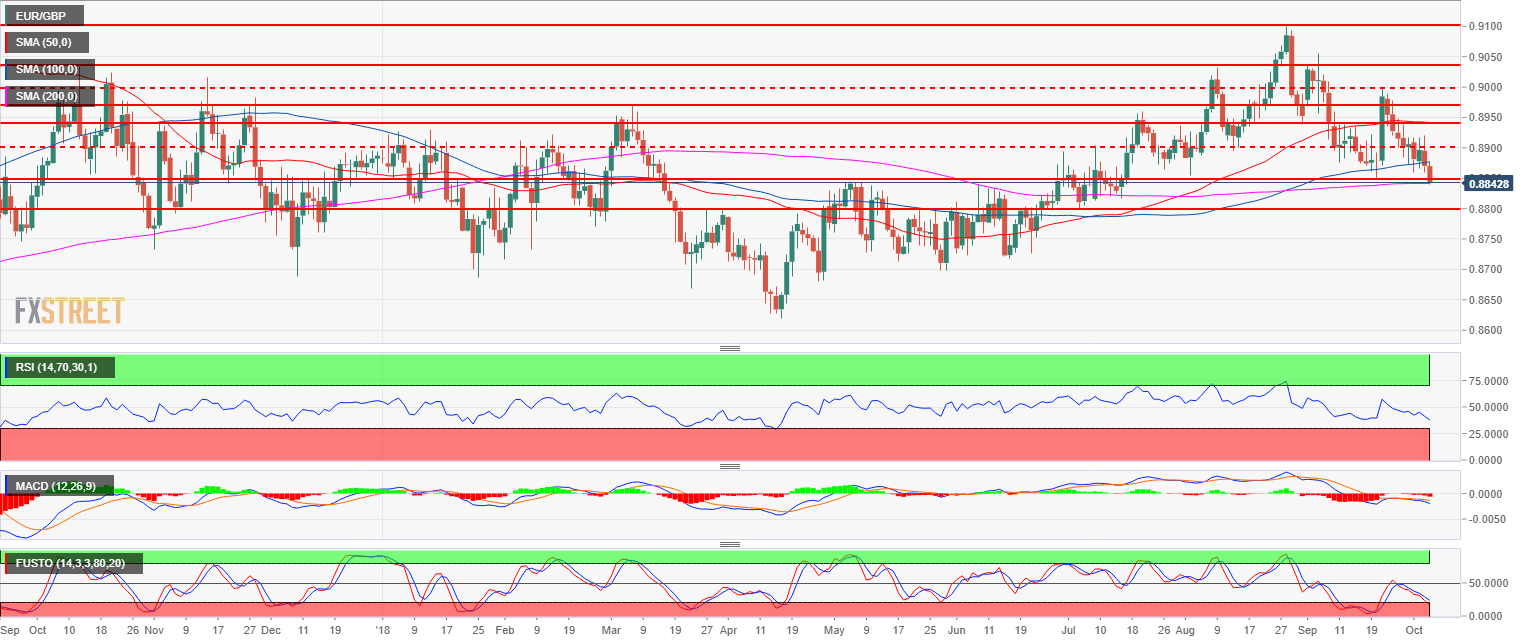

- EUR/GBP is drifting lower as it broke 0.8847 (September 20 low) and is currently testing the 200-period simple moving average.

- The RSI, MACD and Stochastics indicators are bearishly configured on the daily time-frame suggesting continued weakness.

- Targets to the downside can be located near 0.8800 figure and 0.8764 (June 8 low).

EUR/GBP daily chart

EUR/GBP

Overview:

Last Price: 0.8842

Daily change: -28 pips

Daily change: -0.316%

Daily Open: 0.887

Trends:

Daily SMA20: 0.8911

Daily SMA50: 0.8942

Daily SMA100: 0.8876

Daily SMA200: 0.8842

Levels:

Daily High: 0.892

Daily Low: 0.886

Weekly High: 0.899

Weekly Low: 0.8872

Monthly High: 0.9054

Monthly Low: 0.8848

Daily Fibonacci 38.2%: 0.8883

Daily Fibonacci 61.8%: 0.8897

Daily Pivot Point S1: 0.8846

Daily Pivot Point S2: 0.8823

Daily Pivot Point S3: 0.8786

Daily Pivot Point R1: 0.8907

Daily Pivot Point R2: 0.8944

Daily Pivot Point R3: 0.8968

Main Trend: Neutral to bearish

Resistances and Supports:

Resistance 1: 0.8876 September 11 low

Resistance 2: 0.8896 August 14 swing low

Resistance 3: 0.8940 August 14 high

Resistance 4: 0.8974 September 6 low

Resistance 5: 0.9000 figure

Resistance 6: 0.9032 August 9 high

Resistance 7: 0.9100, current 2018 high

Support 1: 0.8847-42 September 20 low and 200-DSMA (key support)

Support 2: 0.8800 figure

Support 3: 0.8764 June 8 low