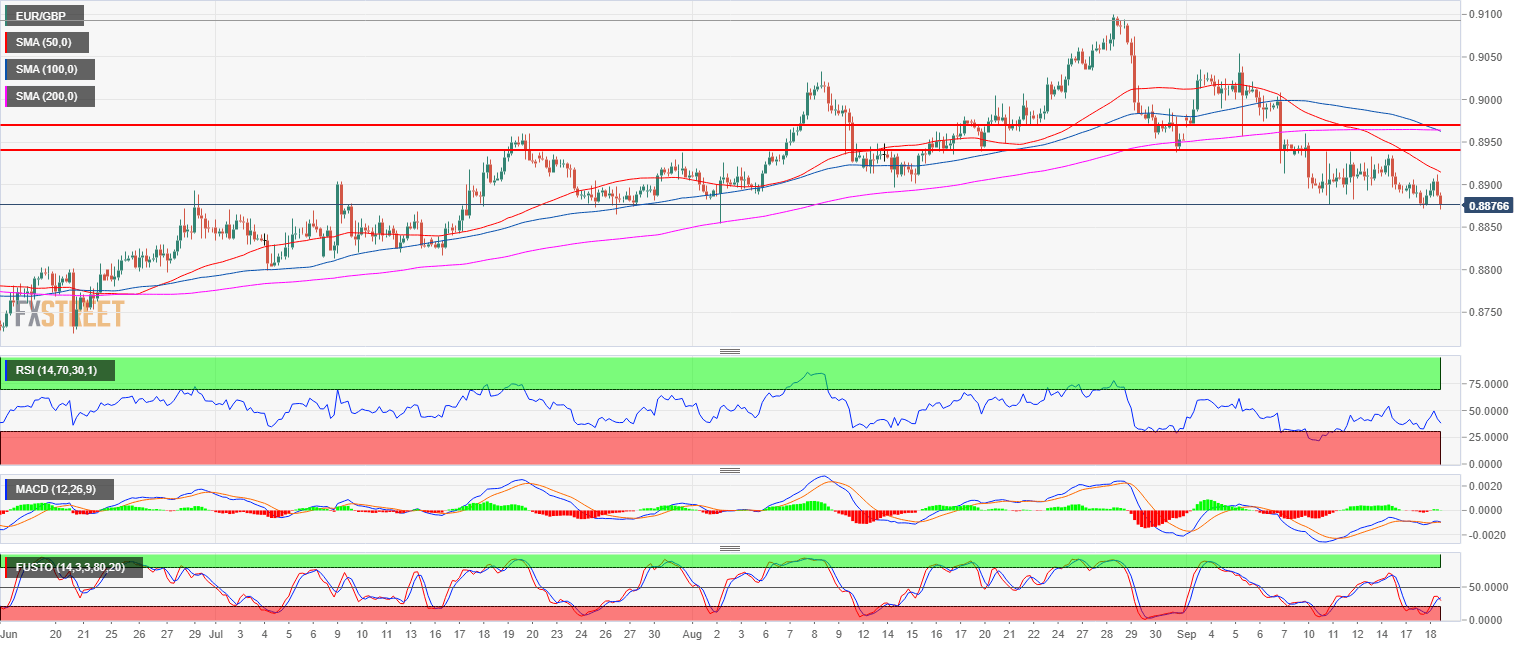

- EUR/GBP main bull trend is on hold for the fourth consecutive week.

- EUR/GBP is trading below its 50, 100 and 200-period simple moving averages while the RSI, MACD and Stochastics are in bearish territories. Targets to the downside can be located near 0.8840 supply level and 0.8800 figure.

- A bull breakout above 0.8940 would invalidate the current bearish bias.

EUR/GBP 4-hour chart

Spot rate: 0.8878

Relative change: 0.01%

High: 0.8911

Low: 0.8870

Main Trend: Bullish

Short-term trend: Bearish

Resistance 1: 0.8896 August 14 swing low

Resistance 2: 0.8940 August 14 high

Resistance 3: 0.8974 September 6 low

Resistance 4: 0.9000 figure

Support 1: 0.8876 September 11 low

Support 2: 0.8840 supply level

Support 3: 0.8800 figure