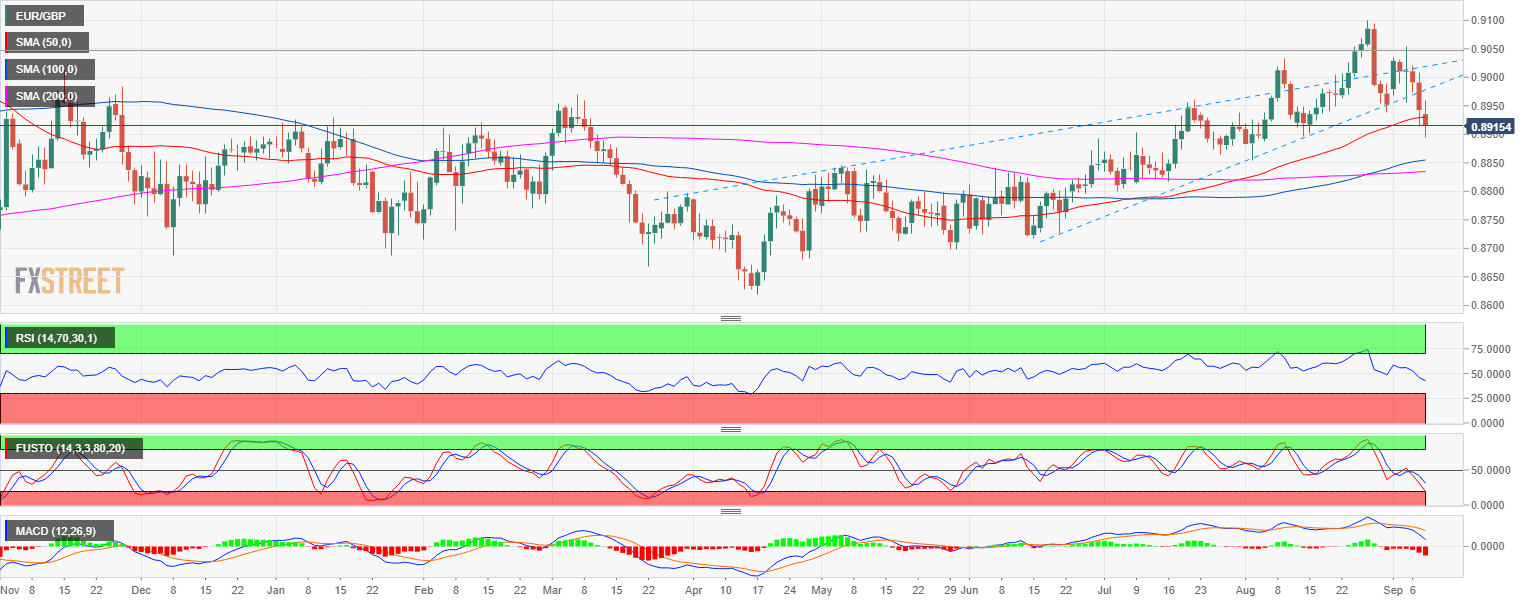

- EUR/GBP main bull trend is now halted as the market broke the 50-day simple moving average and the bullish trendline to the downside.

- EUR/GBP is currently testing 0.8896 (August 14 swing low). The next bearish targets are seen at 0.8864 (July 26 low) and 0.8840 (supply level). While the bias remains bearish short-term with the RSI, MACD and Stochastics are in full bearish mode, the market might need to enter a small consolidation phase first as EUR/GBP just found some support at the 0.8900 figure support.

- A bull breakout above 0.9000 would invalidate the bearish bias.

EUR/GBP daily chart

Spot rate: 0.8914

Relative change: -0.30%

High: 0.8959

Low: 0.8895

Main Trend: Bullish

Short-term trend: Bearish

Resistance 1: 0.8940 August 14 high

Resistance 2: 0.8965 supply/demand level

Resistance 3: 0.9000 figure

Support 1: 0.8896 August 14 swing low

Support 2: 0.8864, July 26 low

Support 3: 0.8840 supply level