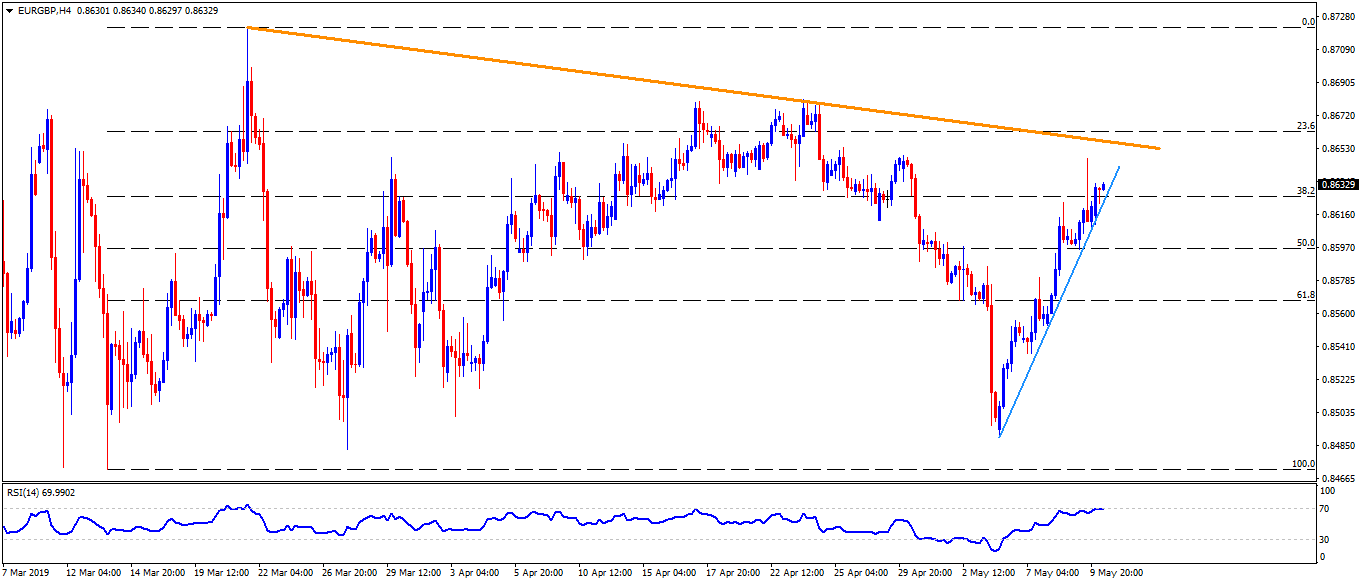

- A descending trend-line stretched late-March could offer immediate resistance with overbought RSI challenging the sentiment.

- The British Pound (GBP) bears the burden of the UK’s political uncertainty.

With an upward sloping trend-line portraying the pair’s strength, EUR/GBP is on the bids near 0.8635 during early Friday.

The pair now heads towards seven-week-old trend-line resistance at 0.8660 but overbought levels of 14-bar relative strength index (RSI) could challenge buyers, if not then 0.8680 and 0.8700 can flash as quotes.

Further, the pair’s extended rise above 0.8700 gives rise to its up-moves to March highs near 0.8725.

Meanwhile, a downside break of 0.8625 support-line can drag prices to 50% Fibonacci retracement of March month upside, at 0.8600 ahead of highlighting 0.8570 marks including 61.8% Fibonacci retracement.

During the quote’s extended south-run under 0.8570, 0.8540 and 0.8500 should become bears’ favorites.

EUR/GBP 4-Hour chart

Trend: Bullish