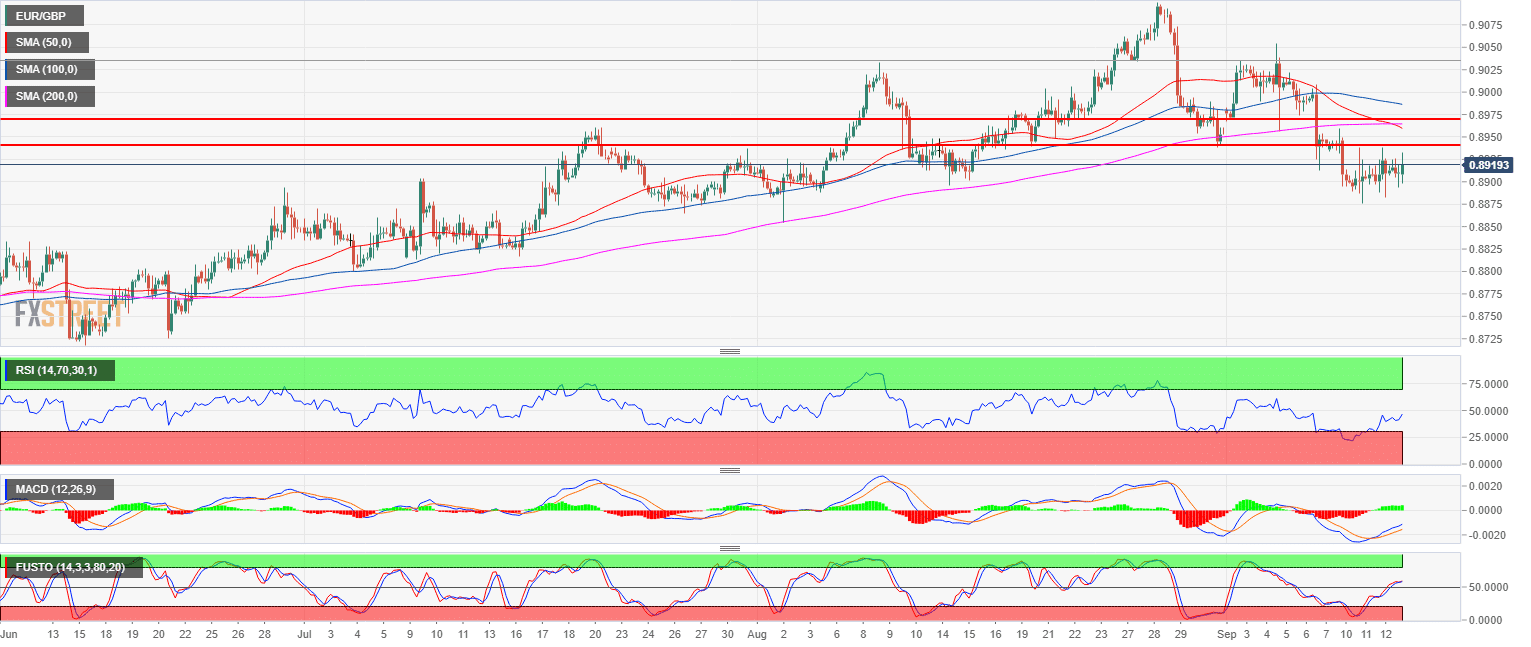

- The main trend has been bullish for the last months and it is likely that bulls will support the market near 0.8900 figure and give another try at resuming the bull rally.

- EUR/GBP is trading below its 50, 100 and 200-period simple moving averages which is rather bearish, however, the RSI, MACD and Stochastics indicators are pointing to more gains. Bulls objective is to reach 0.8940 (August 14 high) and 0.8974 (September 6 low) followed by the 0.9000 figure.

- A bear breakout below 0.8876 (September 11 low) should invalidate the bullish bias.

Spot rate: 0.8919

Relative change: 0.09%

High: 0.8932

Low: 0.8893

Main Trend: Bullish

Resistance 1: 0.8940 August 14 high

Resistance 2: 0.8974 September 6 low

Resistance 3: 0.9000 figure

Support 1: 0.8896 August 14 swing low

Support 2: 0.8876 September 11 low

Support 3: 0.8840 supply level