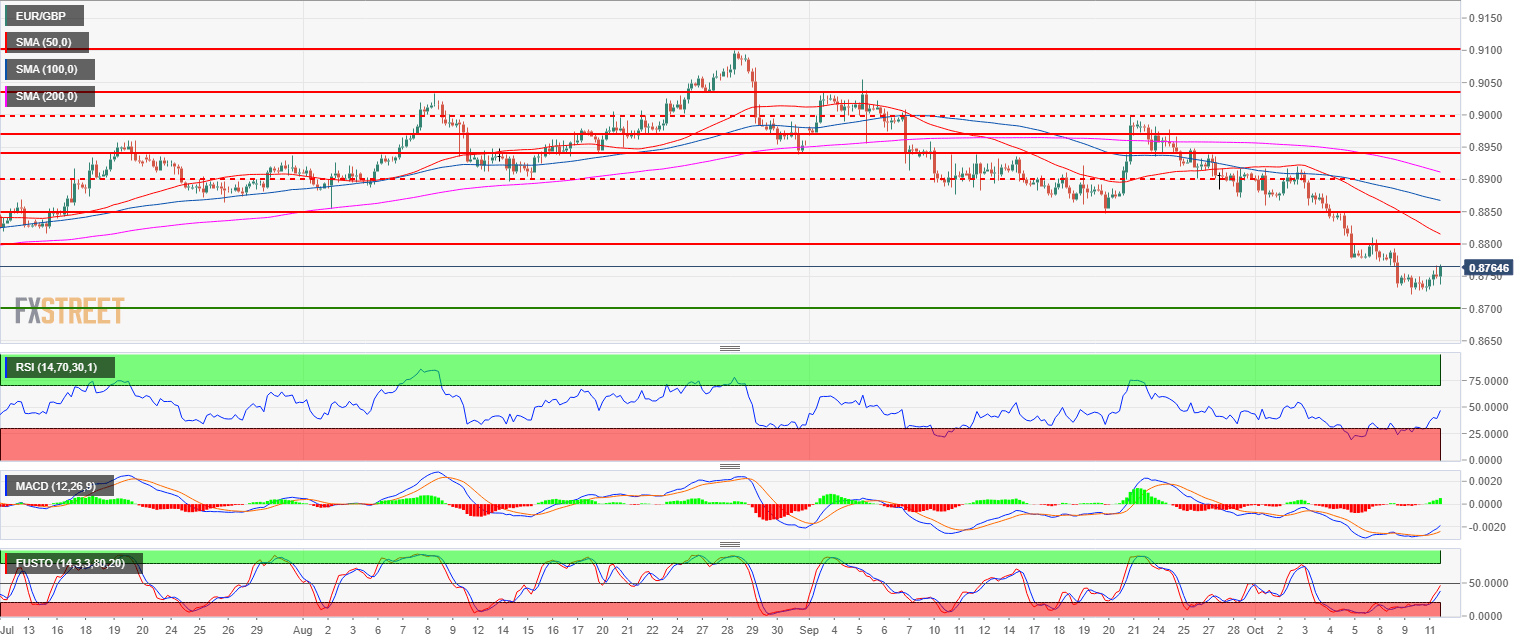

- EUR/GBP is trading in a bear trend below the 200-period simple moving average on the 4-hour chart.

- EUR/GBP is having a pullback up as the market is attempting to form a rounding bottom. The RSI, MACD and Stochastic are rising and constructive to the upside in the near term.

- Resistance can be expected now at 0.8764 (June 8 low) and if broken at the 0.8800 figure where investors will gauge whether to resume the bear trend or letting the bullish pullback extend towards 0.8847 (September 20 low ).

EUR/GBP 4-hour chart

Spot rate: 0.8763

Relative change: 0.37%

High: 0.8766

Low: 0.8729

Main Trend: Bearish

Short-term trend: Bullish

Resistance 1: 0.8764 June 8 low

Resistance 2: 0.8800 figure

Resistance 3: 0.8847 September 20 low

Resistance 4: 0.8876 September 11 low

Support 1: 0.8700 May low

Support 2: 0.8620 current 2018 low

Support 3: 0.8400 May 2017 low