- Break of short-term important supports signal further downside.

- The oversold RSI conditions and 61.8% Fibo. can offer an intermediate pullback.

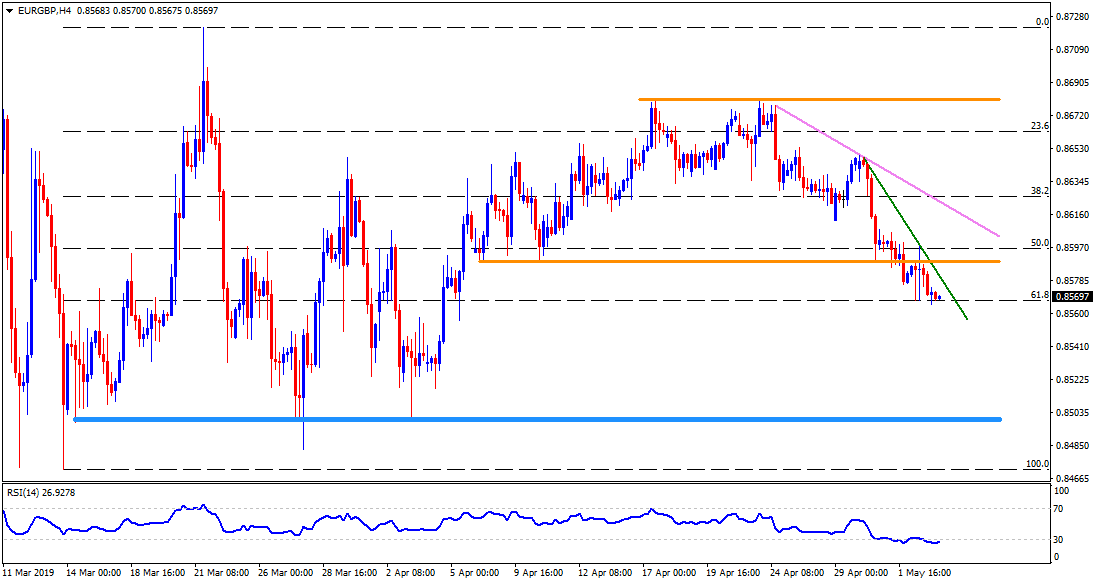

While a break of 0.8590/85 horizontal-support dragged the EUR/GBP pair to a month’s low on early Friday, the quote is currently taking rest on 61.8% Fibonacci retracement of March month upside amid oversold condition of 14-bar relative strength index (RSI).

Immediate descending trend-line at 0.8585 can limit the pair’s pullback ahead of escalating the moves toward 0.8590; though, successful trading beyond 0.8590 can aim for another resistance-line at 0.8630.

In a case where prices rally above 0.8630, 0.8655 and 0.8680 can question buyers ahead of pleasing them with 0.8725 resistance level.

Given the quote slips under 0.8565 support comprising 61.8% Fibonacci retracement, 0.8550 and 0.8520 might flash on bears’ radar whereas 0.8500 – 0.8495 could challenge them during further south-run towards 0.8470.

EUR/GBP 4-Hour chart

Trend: Overall negative with short-term pullback expected