- EUR/GBP stays directionless despite bouncing off six-month lows.

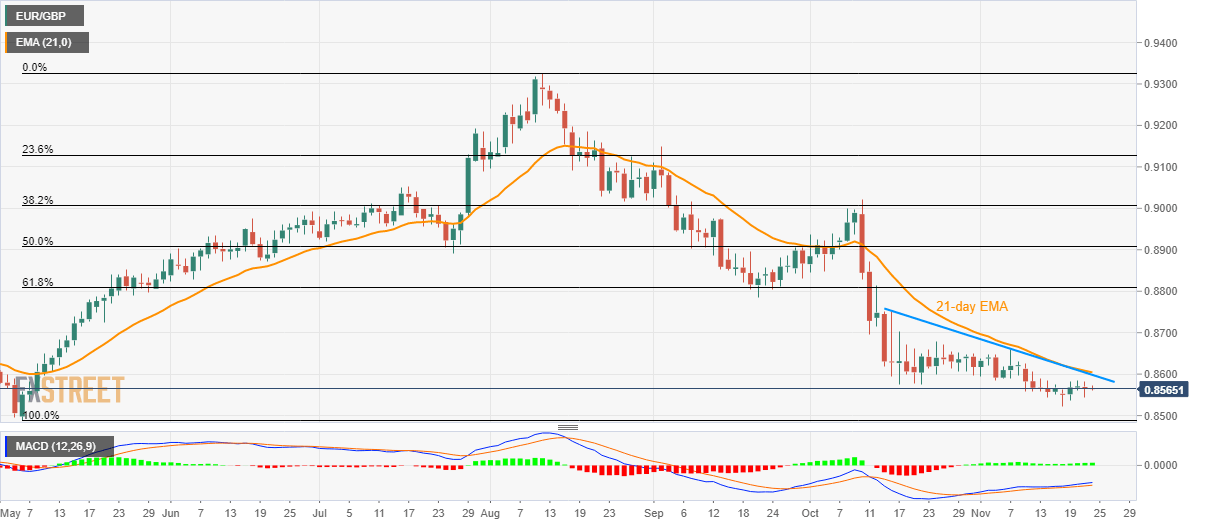

- Prices remain clubbed between the low of Monday’s Doji and 0.8600/05 resistance confluence.

- Broad bearish momentum remains intact unless breaking 61.8% Fibonacci retracement.

EUR/GBP fails to justify Monday’s Doji candle as the quote remains directionless around 0.8565 ahead of the European open on Friday.

The quote bounced off six-month lows on Monday and registered a Doji candle, signaling a recovery. However, prices still stay below near-term key resistance confluence around 0.8600/05 area including 21-day Exponential Moving Average (EMA) and a five-week-old falling trend line.

Should buyers concentrate on the bullish signal from 12-bar Moving Average Convergence and Divergence (MACD), they to stay strong beyond 0.8605 to aim for 0.8680 and mid-October highs near 0.8750. Though, 61.8% Fibonacci retracement level of May-August upside, at 0.8810, could keep the pair’s further upside limited.

Alternatively, a daily closing below Monday’s low of 0.8522 can recall bears targeting May month bottom of 0.8490 and the yearly low near 0.8470.

EUR/GBP daily chart

Trend: Bearish