EUR/USD is getting comfortable in a higher range once again but is far from the highs.

What’s next? The team at Bank of America Merrill Lynch weighs in:

Here is their view, courtesy of eFXnews:

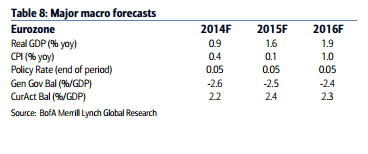

The following is Bank of America Merrill Lynch’s comprehensive outlook for the EUR (released today Aug 31) including the single currency’s current major themes, strategies, forecasts, and risks.

Themes: monetary policy divergence will eventually weaken EUR/USD more. We have been arguing that normalization of monetary policies will be driving markets for years to come. We expect the Fed to lead the way. Other G10 central banks are likely to continue moving to the opposite direction for a while, and then start tightening after the Fed’s tightening cycle has advanced. Even if the Fed delays hiking rates, it will be the first central bank to do so, in our view. We believe that the ECB, at the other extreme, will have to ease policies further. We expect the ECB to miss its inflation target in the months ahead and start talking about QE2, in the form of extending QE after September next year. The timing of the Fed rate hike and the ECB seriously considering QE2 will determine the EUR/USD path, but the final outcome is a weaker EUR/USD, in our view.

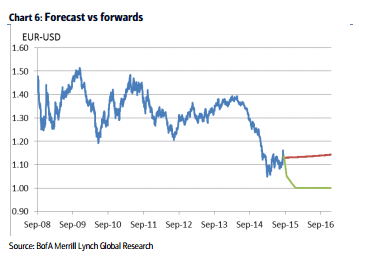

Strategies:We like selling the EUR/USD rallies when we get them, as the path will continue being volatile. We also note that the Eurozone’s unemployment rate is the highest in G10 compared with pre-crisis levels, and that the Eurozone also has the largest output gap (see The USD has not peaked yet). This suggests that EUR/USD could weaken more and remain weak in the medium term.

Forecasts: still parity, but risks have increased. We are keeping our EUR/USD end-2015 projection at parity for now. However, upside risks to our projection have increased notably following the CNY devaluation. The market turmoil has triggered an unwinding of risk positions, which has benefited the Euro as it has become a funding currency. The market has also priced out a September Fed hike (still our call). We will reconsider after the latest market turmoil is behind us. We believe that the risks to our projection will affect only the timing, rather than the end point. Even if EUR/USD does not reach parity this year, we are confident that it will end 2015 well below the current level.

Risks: Fed, ECB, China. If the Fed does not hike this year and/or the ECB sends mixed messages following its new macro projections in the September meeting, EUR/USD could move again to 1.15 or even higher. Negative developments in China will continue supporting the EUR in the short term.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.