We certainly had some moves in markets, with EUR moving down and the pound crashing only to stage a nice recovery. What’s next? Here is the view from Barclays:

EUR: Hedge the downside while it is still cheap.

Here is their view, courtesy of eFXnews:

The EUR weakened last week as the ECB’s Governing Council unanimously agreed to review and reconsider policy at the March 10 meeting. Although the outcome of the meeting was more dovish than we had previously envisioned, given that the ECB had eased policy in December, we are not surprised by the ECB’s course of action given the soft inflationary environment and the material deterioration in medium- and longer-term inflation expectations. Indeed, we take the January ECB meeting to be a strong signal towards future action at the March meeting and think a 10bp deposit rate cut or additional QE is feasible.

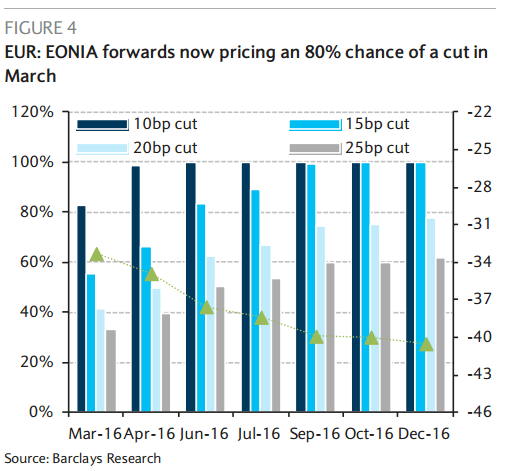

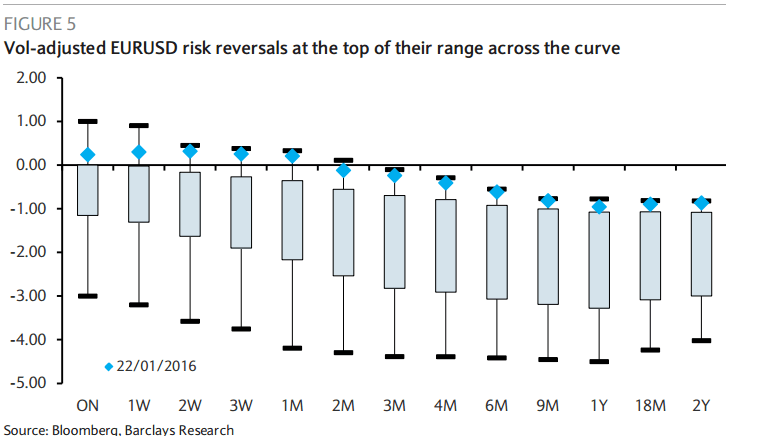

Appropriately, EONIA forwards are now pricing c. 80% chance of a 10bp rate in March (Figure 4). A dovish ECB helped stabilize global risk sentiment but it remains to be seen whether it proves enough to end the recent market rout. A move back to trading fundamentals errs on the side of EURUSD downside, also in the context of underpriced Fed rate hikes this year. Yet, EURUSD puts look historically cheap relative to calls across the curve, offering a compelling opportunity to express downside through options (Figure 5).

Data this week will likely be uninspiring for the EUR. We expect the German Ifo Business Climate (Monday) to print lower this month (108.3 from 108.7 previously) with a decline in the assessment of the current situation fuelling some uncertainty about export performance. Moreover, we project French GDP (Friday) to decelerate 0.2pp to 0.1% q/q in Q4 15, driven by private consumption. Finally, we are slightly below the consensus in expecting euro area ”flash” HICP inflation (Friday) to have edged up to +0.3% in January; however, we are in line with consensus in expecting core prices to have remained stable at +0.9% y/y. We nonetheless expect euro area inflation to return to negative territory between February and July 2016 (see European Economics Quarterly: A challenging ‘missingflation’ recovery, 20 January 2016), a risk also highlighted by the ECB last week.

GBP: Near-term correction in GBP is likely.

Despite another round of uninspiring data, the GBP finally saw a rebound last week following a more dovish ECB press conference. We have highlighted the risk for a EURGBP reversal over the past two weeks as momentum indicators were indicating oversold GBP conditions and see scope for a further move lower in the near term, given the rapidity of the move to the topside and increased market pricing of additional ECB easing in the coming months.

Our expectations for GDP growth this week (Thursday) will likely cap the downside however. We expect GDP to post 0.5% q/q growth in Q4 (consensus: 0.5% q/q, previous: 0.4% q/q), but acknowledge downside risks to our forecasts and continue to look for softer UK growth in the context of expected fiscal tightening.

Although we continue to look for trend depreciation in GBPUSD, we think that a further near-term correction is likely as the market looks for better levels to re-engage in core GBPUSD downside positions ahead of the UK referendum later in the year.

Our revised timing of BoE lift-off (Q4 from Q2 previously) however, continues to represent upside risks to our GBP view in the context of extremely dovish market pricing, which suggests the first rate hike will not occur until May 2017. We expect further GBP weakness against the USD but not the EUR by year-end.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.